PART 1. Introduction of MirrorBase project and community questions.

Hello, Satoshi clubbers and guests of this site. We are happy to present you with another crypto project.

MirrorBASE it’s a new algorithm by mirroring $BASE into double-positive rebases.

MiBASE exists to maintain the negative rebases from $BASE into positive rebases, so users will get more benefits from the rebasing process and to avoid the token rebasing manipulation.

The plan of AMA session:

- Part – Introduction and preselected questions.

- Part – Live questions

- The Quiz about Royal finance

The reward pool is 500$

Leading the AMA our clever and fun admins:

Gold Rocket | Satoshi Club – @GoldRocket27 and D. | Satoshi Club – @Cool_as_Ice

The Representative of the project:

- Mirror Guard – @d_mibase

- @JWhinsky

Introduction of MirrorBASE

D| Satoshi Club:

Hello, again Satoshi Club!

Gold Rocket | Satoshi Club:

Good evening, dear community!

We conclude our today’s AMA marathon series with MirrorBASE Protocol.

D| Satoshi Club:

@d_mibase @JWhinsky hello guys! Welcome to Satoshi club!

Gold Rocket | Satoshi Club:

Today our guests are @d_mibase and @JWhinsky😉

Mirror Guard:

Hello 👋

Whinsky J:

Hello everyone! Glad to be here.

Gold Rocket | Satoshi Club:

Welcome to Satoshi Club, @d_mibase, @JWhinsky!😊 Thanks for joining.

D| Satoshi Club:

So let’s begin with the intro, please introduce yourselves and your project

Mirror Guard:

Hi everyone, Let me introduce myself. I’m MiBASE core developer, you can call me “De” and I have been in the IT space for 11 years as a full stack developer in various companies. Nice to meet you guys!

Whinsky J:

Hi guys, I’m Whinsky. I’m the one who handles the operational things and marketing on MiBASE and as De partner in this space.

D| Satoshi Club:

Nice to meet you guys!

Mirror Guard:

What is MirrorBASE? MirrorBASE and also well-known by MiBASE is a project underlined by BASE Protocol that brings the new algorithm by mirroring the BASE rebases into double-positive rebase.

Gold Rocket | Satoshi Club:

Thanks for the introduction, we will have questions selected for Part 1. ready to start?

Whinsky J:

Sure, please go 🙂

Gold Rocket | Satoshi Club:

🚀

Mirror Guard:

Sure 👍

Preselected questions about the Royal DeFi

Gold Rocket | Satoshi Club:

Q1 from Telegram user @yellowchamp

Many Rebase platforms are out in the market nowadays, so what is the unique and incredible offer that Mirror Base has that will make people likely turn their heads to your platform and utilize your rebasing mechanism? I am not really a fan of rebase, so how will you convince someone like me to try Mibase?

Whinsky J:

Thanks for the question buddy. The unique thing we have is about our algorithm with a mirroring system of another project, in this case, we do mirroring BASE Protocol.

So, the simple way to understand our project is when $BASE gets a negative rebase, $MiBASE will get a positive rebase with double value.

D| Satoshi Club:

Do you guys think, if it’s possible to create a project which would be mirroring your rebase, which based on BASE rebase as well?

Whinsky J:

Since we’re the one who starts this mirroring algorithm, though it will possible to do it.

Mirror Guard:

Sure, but if some project mirroring MiBASE that same as other they reflect as BASE like other rebase project

D| Satoshi Club:

If BASE gets a positive rebase, what happenin with your project?

Whinsky J:

We will get a negative rebase

D| Satoshi Club:

Makes sense 😄

Whinsky J:

With the limit -90%

Mirror Guard:

Ok let me explain some case

Gold Rocket | Satoshi Club:

Very interesting!

Whinsky J:

So, when BASE got +100% rebases, we will get -90% the details will be explained by de.

Mirror Guard:

CASE of MirrorBASE’s use 1

A $BASE holder buys $MiBASE at the same time that day $BASE gets a 20% positive rebase and at the same time $MiBASE gets a negative 20% rebase, the base goes back to the peg price and $MiBASE doesn’t have a peg price so the price is fixed by the amount of eth pool and $MiBASE pool at Uniswap 50:50 if a negative rebase then the price of $MiBASE will increase according to the negative proportion obtained, in this position a holder does not get any profit or loss

CASE of MirrorBASE’s use 2

A $BASE holder buys $MiBASE at the same time that day $BASE gets a negative 50% rebase and at the same time $MiBASE gets a positive 100% rebase (2x from negative $BASE to positive), $BASE returns to the peg price and $ MiBASE does not have a peg price so the price is determined by the amount of eth pool and the $ MiBASE pool at Uniswap 50:50 if a negative rebase then the $ MiBASE price will decrease according to the positive proportion obtained, in this position a holder gets 50% profit

CASE of MirrorBASE’s use 3

A $BASE holder buys $MiBASE at the same time that day $BASE gets a positive 300% rebase and at the same time $MiBASE gets an only negative 90% rebase (max negative 90% if base get 100% more), $BASE returns to the peg price and $ MiBASE does not have a peg price so the price is determined by the amount of eth pool and the $ MiBASE pool at uniswap 50:50 if a negative rebase then the $ MiBASE price will increase according to the negative proportion obtained, in this position a holder gets 210% profit

Gold Rocket | Satoshi Club:

Sounds good!

D| Satoshi Club:

Sounds a bit complicated, but interesting as well😊 Okay, thank you guys for the clarification! let’s continue our questions?

Gold Rocket | Satoshi Club:

As far as I understand for the holder, the position is a win-win.

Mirror Guard:

The idea comes because I see many holders and my friend bought $BASE and I saw that many suffer losses when they did not reach the target price and get negative rebased after base FOMO gets 300% positive rebase, and I think if mirror it can help them to reduce losses so create MiBASE as co-asset, so please don’t make $BASE and $MiBASE as a competitor 😁

Mirror Guard:

Sure 👍 Yes of course 😁

Gold Rocket | Satoshi Club:

Q2 from Telegram user @Arabedans

MIBASE With your algorithm changes negative rebases in positive fees with double X. Everyone can readjust MIBASE after $ BASE performs its readjustment by paying the transaction rates. Could I explain how do I realize readjusts in Mibase? Explain also how this algorithm works to make these conversions?

Whinsky J:

So, the way MiBASE works is by hitting the REBASE button and pay for the fee tx to activate the rebase. So, everyone can do rebasing at the same time as BASE rebasing

Whinsky J:

We depend on how BASE going.

D| Satoshi Club:

Ok, I’m also very curious, what would happen with your project, if let’s say, BASE project stops exist tomorrow. what will you do?

Mirror Guard:

We can change and mirroring other projects rebase with community vote as our contract owner is multisig with WOR so we cant change without community permission

Whinsky J:

We can mirroring other projects not focusing on one project.

D| Satoshi Club:

HaHa, nice!

Whinsky J:

Will keep mirroring

Gold Rocket | Satoshi Club:

LoL! That’s very smart! 😁

Whinsky J:

That’s our concept lol.

D| Satoshi Club:

Got it. in this case, you have a Plan B😄

Gold Rocket | Satoshi Club:

You have great ingenuity!👍

Whinsky J:

Exactly, we have to!

Gold Rocket | Satoshi Club:

Tell us a bit about your team btw

D| Satoshi Club:

Ready for the third question guys? After this then😄

Mirror Guard:

For now, we have 2 solidity programmer and 1 web developer including me as core dev and 1 marketing

Whinsky J:

Yes, and we also have a very great community as part of the team!

Gold Rocket | Satoshi Club:

Thanks for the answer👍 A good community is the foundation of a good project!😊

Mirror Guard:

Yes forgot about this one all community part of us

Gold Rocket | Satoshi Club:

Q3 from Telegram user @PaulMonte20

While there is not much information about the Rapids’ functionality (at least not yet I believe), in a recent interview you’ve explained that Rapids (quoting) “[…] will be used by the community of $MiBASE holders to add to their tokens by becoming an LP and for staking. At the same time, the Rapids’ rewards will be influenced by $MiBASE’s negative/positive rebates”. Despite this explanation, I still have quite an unclear picture of the Rapids’ inner workings and mechanism. Could you please describe again how will MirrorBasers be able to use and benefit from this functionality together with LP and staking? And last but not least, how specifically will rebases interconnect with Rapids’ rewards?

Whinsky J:

For our Rapids, De will give you the explanation.

Mirror Guard:

rapids same as other staking LP but we find the best formula for it make more benefit for all staker like tax fee for who claim the reward and turn back into rapids pool, and yes if rebase negative or positive will impact with $MiBASE reward balance, but the reward will same as value total supply

Gold Rocket | Satoshi Club:

I hope @PaulMonte20 is happy with the answer and I have my own question for you 😉 Tell us please about your tokenomics btw.

Whinsky J:

Our tokenomics littlbit interesting tho

Initial Supply: 55,000 MiBASE

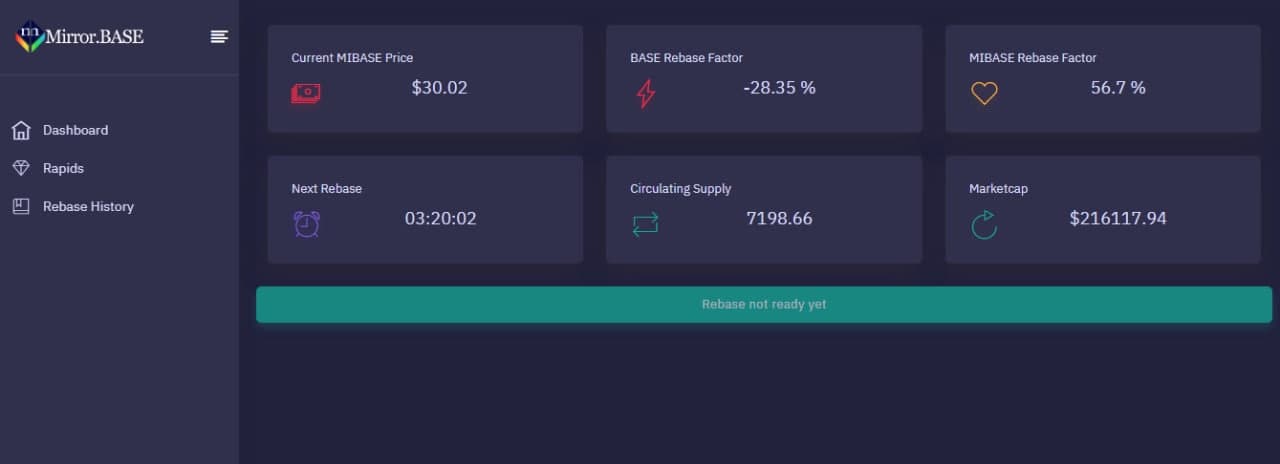

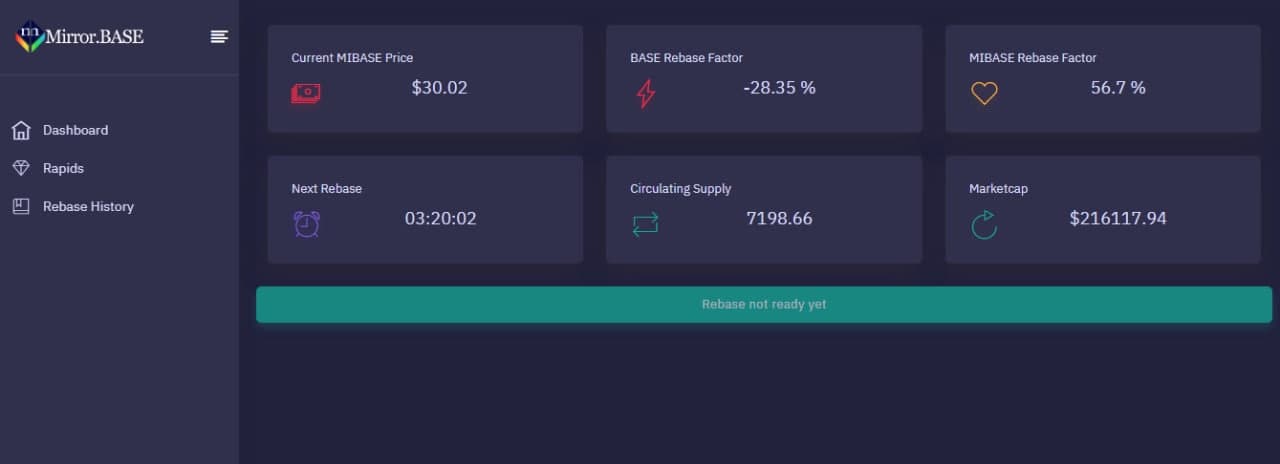

and Burnt for about 28,080 MiBASE (unsold token from presale allocation and the rest 18,000 are locked with multisig and our circulating supply is about 7,1k MiBASE. You can find the details market cap here: https://dashboard.mirrorbase.finance/

Its fair distribution

Gold Rocket | Satoshi Club:

Thank you! This was a must-have question! 😉 Can we proceed to the next question?

Mirror Guard:

Yes, sure 👌

Gold Rocket | Satoshi Club:

Q4 from Telegram user @borysfireball

You stated that you are inspired by BASE… But as I follow this situation for a long time I know that WarOnRugs blamed $Base to be a scam project. Then MirrorBASE Protocol appears and gives multi-sig to WarOnRug admin, this means you trust him enough. What is going on? Is this war of rebase projects?

Hmm… tough question …

Whinsky J:

Why we co-sign with WOR is we want to give transparency on our project to the community. I don’t think that this is a war between rebase project. Since we both are on a win-win solution.

Gold Rocket | Satoshi Club:

Thank you for the honest answer! 👏👏👏

Whinsky J:

My pleasure😀

Gold Rocket | Satoshi Club:

Can we proceed? Or you want to add something?

D| Satoshi Club:

I don’t understand the whole premise of this drama tbh 😁 wars on Twitter?

Whinsky J:

We have some info for all community that we are developing our Rapids rn and it will launch at the end of the year.

Mirror Guard:

Ok let me tell you a story from the start when we make some presale one admin base come and make some fud on us so our starting not going well low trust and then WOR come many people there ask wor about our project as you know WOR is a war on rug project and many users ask for make multisig with wor because they don’t want rug by dev and I think this can make more user trust our project after fud by some base admin that’s why we do multisig with WOR

D| Satoshi Club:

Great news! 👏

Whinsky J:

Thought this was a normal situation. it’s a community no one can deny this.

Gold Rocket | Satoshi Club:

Sure!👍

Whinsky J:

But we didn’t called it a war, we saw this as their support for us and so the BASE community

Gold Rocket | Satoshi Club:

Nice. Next question?😉

Whinsky J:

No offense, we thankful for BASE Protocol too. Sure, go ahead.

Gold Rocket | Satoshi Club:

Q5 from Telegram user @Pratze

For some people including me, rebase only mean to manipulate the token price. Even the token price is up, it will be only temporarily because others will try to sell and make the price down again. How mirrorbase opinion about this problem? It is important to stay in a civilized relationship 👍

Whinsky J:

Exactly! Wait de will answer that question.

Gold Rocket | Satoshi Club:

Take your time!

Mirror Guard:

Yes normally rebase positive people will take some profit right? use case $Mibase is co-asset as you hold base that means you need to hold Mibase as well, other base holder and need to save their investment for negative rebase they will buy $Mibase or do opposite sell when base negative then buy Mibase or Sell Mibase when base positive then buy more base.

D| Satoshi Club:

What are the next steps in the development? do you have a roadmap? what we can expect from you in Q1 2021?

Whinsky J:

I’m arranging some plans to be added to our roadmap that we will release as soon as it ready

D| Satoshi Club:

Gotcha

Whinsky J:

For now, we’re focusing on Rapids and updating our website, and upgrade its security.

D| Satoshi Club:

Also, vital things👌 Thank you! ready for the last question from this part?

Gold Rocket | Satoshi Club:

Everything is clear to me!

Whinsky J:

Ofc. you can go with the last question

Gold Rocket | Satoshi Club:

Q6 from Telegram Username @zaferce

Why does MiBASE prefer the elastic procurement model and thus how will MiBASE bring more benefits in the repayment process, avoid payment manipulation?

Mirror Guard:

Bring it on 🥳 Because the main idea is mirroring $BASE (rebase) have elastic supply that why we do the same way, on mibase there no manipulation because everyone can hit rebase button on our website

D| Satoshi Club:

Btw how often rebase occur during the day?

Whinsky J:

Once a day or depends on BASE rebasing. You can check the countdown on our dashboard. And seems today we will get double positive. Let’s wait till the time coming.

Gold Rocket | Satoshi Club:

@d_mibase @JWhinsky You can post useful links for our community before we open chat for the live questions😊

Whinsky J:

For everyone, we are inviting you to be part of our community by following our social media here:

Website: https://mirrorbase.finance

Telegram: https://t.me/mibaseprotocol

Twitter: https://twitter.com/mibaseprotocol

Medium: https://medium.com/@mibaseprotocol

D| Satoshi Club:

let’s join Satoshiclubbers!

Gold Rocket | Satoshi Club:

Thanks for sharing👍🚀

Whinsky J:

And you can contact me personally if you have any further questions about MiBASE. Thank you, guys!

Mirror Guard:

Thank you to everyone who asks in this AMA thanks to Satoshi Club, our community holder, WOR

Come join us @mibaseprotocol

Gold Rocket | Satoshi Club:

Thank you, guys! It’s really not easy to create something new and not ordinary. You are great! Keep going! @d_mibase and @JWhinsky

D| Satoshi Club:

And now let’s open the chat!!!! 🚀🚀🚀 I will open chat for 120 seconds.

PART 2.Questions about the MirrorBASE project from the live chat of the telegram community.

In this part, we open a chat for the crypto community for 120 seconds. Then the guests from the MirrorBASE crypto project choose the top 10 questions. The 10 crypto enthusiasts have earned cryptocurrency in the sum of 100$.

Q – 1 from a telegram user @BboyForteVZLA

Can you provide your link Uniswap to buy your token?

Whinsky J:

This is our dextool link: https://www.dextools.io/app/uniswap/pair-explorer/0xdaefbed9d35f505444527746393f015b8c84df2b

Q – 2 from a telegram user @Eliasbb

MiBASE is a project inspired by $BASE protocol. So, tell me why should users choose a copy version rather than choose the original one? Thx.

Mirror Guard:

Inspired does not mean copying as we have previously explained we mirror its opposite rebase factor 😁

Q – 3 from a telegram user @Beterror203

Hello @d_mibase @JWhinsky One of the base problems is that they do not calculate the FOMO and this causes a less exact calculation in the base algorithm, how does MirrorBASE calculate these charges based on base?

Mirror Guard:

We capture base supply before and after rebase in our smart-contract that how we how much rebase factor on base then mirror it 😁 so no manipulation on our rebase because supply base cant controlled by Mibase dev

Q – 4 from a telegram user @araceley

Have your smart contracts been audited by any third party firm yet, if yes, have all issues been resolved and your contract now secured? Where can we view the audit report?

Joe Wong:

We haven’t done the audit. if some of you want to audit our smart contract then please do, we are open to it. We have multi-sig on it and I think it can make the community feel secure. thank you.

Q – 5 from a telegram user @LLeeKuanYew

Hello @d_mibase @JWhinsky

What is the relationship of MirrorBASE Protocol with Base Protocol project?

Joe Wong:

We have no relation. MiBASE inspired by BASE and we do mirroring on it.

Q – 6 from a telegram user @K2ice

So when $BASE gets a negative rebase, $MiBASE will get a positive rebase with double value. Does that mean that $MiBASE will get a negative rebase with less value if $BASE gets a positive rebase?

Joe Wong:

Yes, when the base gets a positive rebase the mibase will get negative, so it will decrease your token.

Q – 7 from a telegram user @SutedjaDian

What is the relationship between $BASE and $MirrorBASE? Is MiBASE price directly connected with $BASE token?

Mirror Guard:

We don’t have any relationship with base and our price doesn’t have any peg with base or other, we only capture base supply with their rebase.

Q – 8 from a telegram @Gutike95

Is this new algorithm used in MirrorBASE only functional for the Base Protocol? or in the future could it be used in any other protocol?

Whinsky J:

It can be used for another rebase project.

Q – 9 from a telegram user @A5loveZ3

Have you done ICU, IEO, in any CEX exchange, or IDO in any DEX exchange?

Whinsky J:

We have our presale about 3 days ago. and we’re focusing on growing our community and our LPs

Q -10 from a telegram user @Protradeid

Hi, @d_mibase @JWhinsky My Question: What is your strategy for building a strong community? Do you agree that the power of the community will lead your project to develop globally? What services do you provide to the community?

Mirror Guard:

With trust 😁 good for the project and community as well so we will make that happen.

Part 3 – Quiz about project

In the final part, we would like to check your knowledge in terms of the MirrorBASE project. They’ve prepared 4 questions for this part, so everyone could be a part and answer. Participants had 10 minutes to answer. 300$ was distributed between the winners.

Our contacts for more details:

English Telegram group | Russian Telegram group | Spanish Telegram group | Telegram Channel | Twitter | Website

Our Crypto Partner by this AMA: Royal.finance

Telegram group | Tweeter | Website | Medium