PART 1. Introduction of PolkaFoundry project and community questions.

Hello, Satoshi clubbers and guests of this site. We are happy to present you with a project called PolkaFoundry.

PolkaFoundry is a One-stop dApp factory providing interoperability with DeFi and Web 3.0 ecosystems.

- Leveraging the thrilling ecosystem, true interoperability, and the unprecedented scalability of Polkadot and Substrate;

- Unique UX-enabling features bring DAPPs to a much broader population;

- EVM-compatible, straightforward to migrate from Ethereum;

- Built-in made-for-DeFi services make it easy for DeFi apps to manage identities, store files, and access Oracle data.

The plan of AMA session:

- Part – Introduction and preselected questions.

- Part – Live questions

- The Quiz about PolkaFoundry

The reward pool is 800$

Leading the AMA our clever and fun admins:

Mary | Satoshi Club – @madamlobster and Gold Rocket | Satoshi Club @GoldRocket27

The Representative of the project:

Thi Truong (pronounced as Tee) – @thi_pkf – PolkaFoundry Co-founder

Introduction of PolkaFoundry project.

Mary | satoshi club:

Hello, satoshi club! We are happy to announce our ama session with Polkafoundry! Welcome to satoshi club😀

Gold rocket | satoshi club:

Hello, dear satoshi clubbers!

Today our guest is @thi_pkf!😊

Thi | Polkafoundry | co-founder & ceo:

Hey there, thank you, everyone, glad to be here, this group is huge 😀

Mary | satoshi club:

Welcome here 👍 how’s going?

Gold rocket | satoshi club:

We are also very excited about the upcoming ama😁

Thi | Polkafoundry | co-founder & ceo:

Yeah, let’s start!

Mary | satoshi club:

Could you please introduce yourself and tell us more about Polkafoundry?😀

Thi | Polkafoundry | co-founder & ceo:

Sure mary. My name is Thi truong (pronounced as tee). I’ve been working in the software industry for 10+ years.

Mary | satoshi club:

It’s a long term 👍

Thi | Polkafoundry | co-founder & ceo:

I started my career in blockchain with Kyber network 3 years ago, working as a key member of Kyber core team. It was a good time, working with many talented people, I learned a lot. A year later, I quit Kyber and founded Icetea platform which is Polkafoundry now.

Mary | satoshi club:

Sure, it’s a great team!

Thi | Polkafoundry | co-founder & ceo:

It was a great journey we went through the winter of crypto and sustain to this day

Gold rocket | satoshi club:

Impressive background👍

Thi | Polkafoundry | co-founder & ceo:

Yep, the leaders are visionary. Thank you.

Mary | satoshi club:

Yes, I still can’t believe the winter is over😂

Thi | Polkafoundry | co-founder & ceo:

Haha, winter is a good time though.

Mary | satoshi club:

What is the main concept of Polkafoundry?😀

Gold rocket | satoshi club:

Tee! How did you get to be involved in Polkafoundry?

Mary | satoshi club:

Yes, it’s the best time for development 😉

Thi | Polkafoundry | co-founder & ceo:

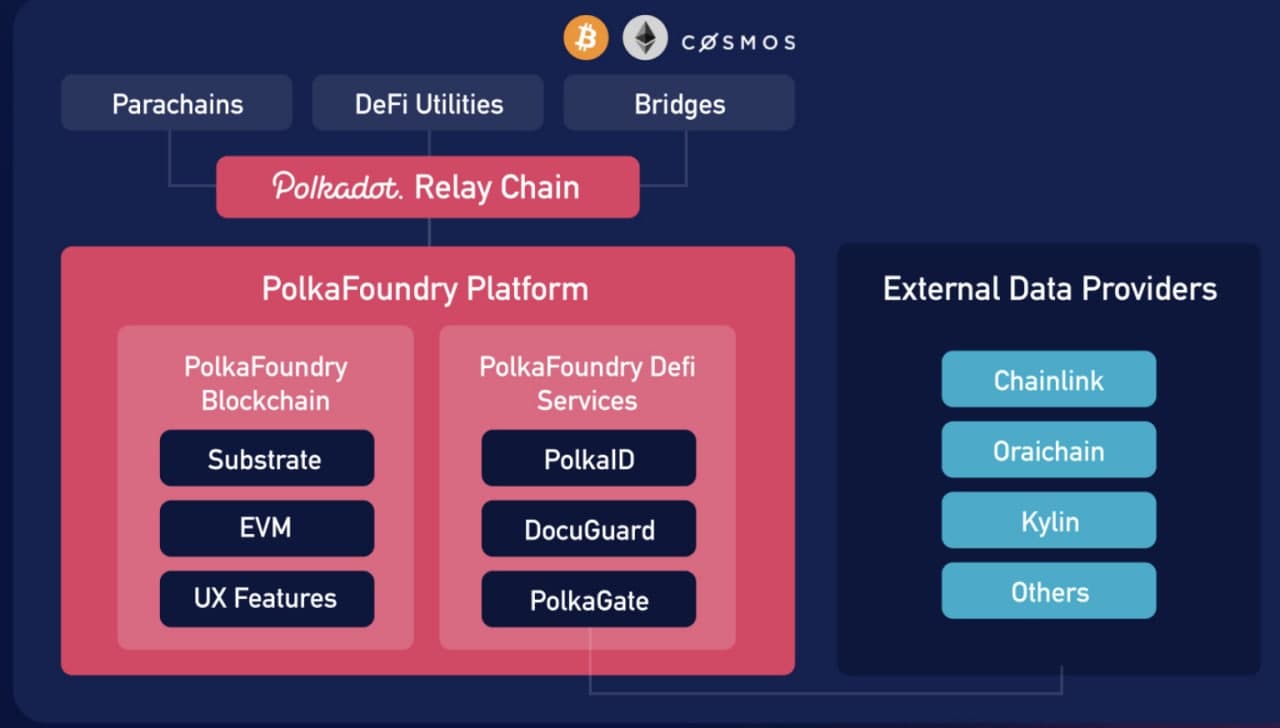

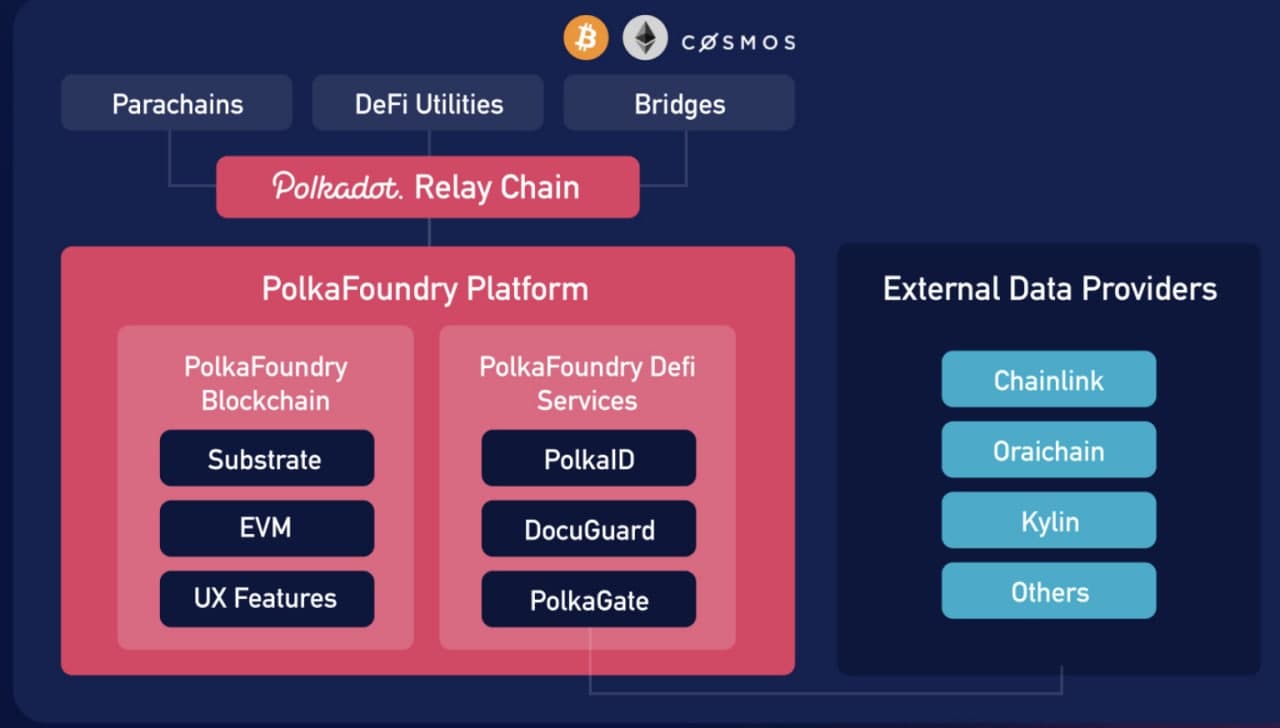

Polkafoundry is “a production hub for DeFi apps on Polkadot”. When I told my friends so, no-one understands 😊 So, let’s look at this picture:

Basically, Polkafoundry is a DeFi-friendly platform for developers to build DAPPs

Gold rocket | satoshi club:

Why did you choose Polkadot out of all blockchains? 😊

Thi | Polkafoundry | co-founder & ceo:

It includes:

– a blockchain with innovative features

– a set of built-in DeFi-friendly services

It is straightforward to develop new DAPPs as well as migrate existing DAPPs from Ethereum

Yeah, that’s it

I hope it is clear enough mary

Gold rocket | satoshi club:

Great intro👍

Mary | satoshi club:

Yes, it’s enough for the beginning and it’s impressive 👍 I like when everyone’s life becomes easier 😀

Gold rocket | satoshi club:

Are you ready for questions from Satoshi Clubbers?😁

Mary | satoshi club:

Thank you, Thi for your great intro!

Thi | Polkafoundry | co-founder & ceo:

I am ready!

Mary | satoshi club:

Let’s go 🚀

Preselected questions about the PolkaFoundry DeFi project.

Gold rocket | satoshi club:

Q1 from telegram user @highpee

You founded the Icetea platform but later rebranded to become what is now known as Polkafoundry. Why was this rebranding necessary and how does this benefit Polkafoundry? Also, I also discovered that the old platform is still active and the website (icetea.io) is currently functioning with the information on the two websites similar. To avoid confusion and ensure that am not interacting with the wrong website, I want to know who are the ones now operating the old platform or whether you are still running both platforms simultaneously?

Thi | Polkafoundry | co-founder & CEO:

Thank you, great question.

We decided to join the Polkadot ecosystem. That’s why we change the name to closely reflect what we are doing

So we rebranded. The old website still works, and it is valid, As we migrate to Polkadot, the old blockchain still works perfectly. When we finish the Polkadot version, we will migrate the old DAPPs to the new blockchain.

Mary | satoshi club:

You had your own blockchain there?

Gold rocket | satoshi club:

This is unexpected, to be honest. That is, are you planning on using both?😁

Thi | Polkafoundry | co-founder & ceo:

No, the old blockchain is considered phase 1. The new one on Polkadot will replace the old one, and it is phase 2. But we can reuse most of our knowhow, features, etc. And bring it to phase 2.

Polkadot ecosystem is growing rapidly recently. We belleve our experience and innovative solutions can contribute significantly to its development

Gold rocket | satoshi club:

I am sure that your intuition and experience did not disappoint you! 👍

Mary | satoshi club:

Was your community happy about this decision?

Thi | Polkafoundry | co-founder & ceo:

Yes, i did it because it is good for our community. When we do our own blockchain, it is very hard to build developer community, you need very large financial and support.

Mary | satoshi club:

So, everyone is happy and Polkadot got a perfect member of its ecosystem 😀👍 that’s great.I understand .😀

Thi | Polkafoundry | co-founder & ceo:

It is now better to join the thrilling ecosystem like Polkadot. We need friends, partners to realize our vision. It is hard to go alone

Gold rocket | satoshi club:

By the way, tell us a little more about your team of like-minded people.

Thi | Polkafoundry | co-founder & ceo:

We are an global team of 20+ members, since 2018, located in several countries

Gold rocket | satoshi club:

How many people make up the core of the team, what kind of work do they do?

Thi | Polkafoundry | co-founder & ceo:

Team & advisor experience includes Kyber network, Tomochain, Harmony, JP morgan, Delloite, PH.D at Kyoto university, etc.

Gold rocket | satoshi club:

In the days of covid, this is really good!👍

Thi | Polkafoundry | co-founder & ceo:

We are backed by Rikkeisoft, one of the biggest software companies in Vietnam with 1200 developers, and can support us with high-quality developer resources.

Image how that’s different! Many other blockchains goes with marketing first, and struggle to outsource their tech part

Mary | satoshi club:

Wow! With such support, you can do big things 🚀

Thi | Polkafoundry | co-founder & ceo:

We are also strategic partnership with Duckdao who will back our early-stage growth with long-term investment

Mary | satoshi club:

Yes, you are right, it’s really different

Thi | Polkafoundry | co-founder & ceo:

And partner with momentum 6, the marketing company that is behind the marketing of many successful blockchain projects like harmony, Mantra DAO, APY. Finance, etc. It is lucky that we are backed by top VCS.

Mary | satoshi club:

Oh, familiar names 😀

Thi | Polkafoundry | co-founder & ceo:

Yeah, we are confident about our team, but still looking for talents from all over the world. Haha, enough about the team I guess.

Mary | satoshi club:

It’s impressive info! Really great team for a great project 😀 Thank you for your answers, Thi! Ready to proceed?

Thi | Polkafoundry | co-founder & ceo:

I am ready.

Gold rocket | satoshi club:

Yes, so many excellent partnerships👍

Q2 from telegram user @mihaipisica

As we know, Polkafoundry is the newest project to host a public sale on the Duckstarter platform and offer public allocations for users. One important note about this Duckstarter offering is that it’s going to be a lottery. There are only 100 seats available, and $50k in allocations. My questis: what are the terms and conditions for users to join the Polkafoundry ido? How we can get a Duckstarter tier and what are the steps to be eligible for it? Can you explain please a bit the Duckstarter process? Is there a KYC process to complete? And is there any restriction for some countries?

Thi | Polkafoundry | co-founder & ceo:

Originally, we plan to do dual IDO on both Duckstarter and paid ignition on 10 mar.

But due to the hack happens to paid, we decided to delay it

Gold rocket | satoshi club:

It’s tomorrow!😁🚀

Thi | Polkafoundry | co-founder & ceo:

We will make an official announcement about our new IDO in a few hours

Mary | satoshi club:

It’s sad🤷

Gold rocket | satoshi club:

Would you like to tell us more about this?

Thi | Polkafoundry | co-founder & ceo:

But it is postponed for about 1 week. It will be announced in a few hours, so please wait for it 😁 But we will honor the ones who already did the whitelist on paid.

Mary | satoshi club:

You know, I like crypto shopping very much. Really, how do you rate the chances of the ordinary crypto users getting some of your tokens?😂

Thi | Polkafoundry | co-founder & ceo:

They will do the lottery, so it is hard to get a ticket though.

Gold rocket | satoshi club:

Well let’s try our luck😁

Mary | satoshi club:

I feel it is near zero. Tell us why you are distributing so small amount of tokens for IDO?

Thi | Polkafoundry | co-founder & ceo:

For Duckstarter whitelist process, let’s follow the link

We will extend the whitelist period and add an extra public pool

Let’s wait for the announcement

Mary | satoshi club:

Oh, ok! We will stay tuned 🙂 Thank you for your answers! Ready to jump to the next question?

Thi | Polkafoundry | co-founder & ceo:

Yeap.

Gold rocket | satoshi club:

Thanks for sharing👍

Gold rocket | satoshi club:

Q3 from telegram user @jesusfre1tes

Polkafoundry is designed to give developers free rein to explore new horizons of the DeFi landscape. My question is, what are the tools you provide to these developers so they can innovate and create innovative DAPPs, never seen before in the DeFi space? These DAPPs will only be compatible with the Polkadot network? Do you plan to adapt your protocols to other blockchains?

Thi | Polkafoundry | co-founder & ceo:

Great question. First, we are Ethereum compatible, so it is straightforward to migrate apps from there.

And developers can use their familiar Ethereum tools like the remix, Metamask, truffle to develop on Polkafoundry

Gold rocket | satoshi club:

This is very good i think👍

Thi | Polkafoundry | co-founder & ceo:

Second, we provide easy-to-use wrappers and APIs for services such as decentralized identity, decentralized storage, and hand-selected oracles. Finally, we offer what we call ” UX-enabling” features, to allow developers to create DAPPs that are most easy to use by normal users. You know, DAPPs are hard to use for mere mortals, onboarding is very hard. Just to give some examples of our UX-enabling features:

Mary | satoshi club:

Sure! Do you already have developers which are ready to use your services?

Thi | Polkafoundry | co-founder & ceo:

- Signing key: used in place of the private key, each signing key has an expiry time and a limited set of permissions. Thus, leaking yields much less serious consequences.

This more efficient signing process improves both DAPP security and the ux safeguard the keys.

- Flexible payer: DAPPs can pay transaction fees for users in a decentralized manner.

As a result, DAPPs can employ much more flexible monetization strategies, such as free, freemium, pay-to-unlock, and in-DAPP-purchase models. Onboarding becomes seamless.

- Polkaid: an off-chain service that encrypts a user’s key, splits it into parts, then distributes the keys to multiple independent and secure key management services.

This shifts the burden of keeping keys from users, while still preventing illegal access from any single central authority

Gold rocket | satoshi club:

Absolutely right! Mass adoption needed!

Thi | Polkafoundry | co-founder & ceo:

I will push forward the DAPPs UX because we believe it is the road to mass adoption

Mary | satoshi club:

Signing key can be used instead of the private key, right? But users can still use their pk, right?

Thi | Polkafoundry | co-founder & ceo:

Sure. But DAPPs could use a signing key if they don’t need the private key.

Mary | satoshi club:

Got it, it’s something new for me😀

Thi | Polkafoundry | co-founder & ceo:

It is like the CEO, assigning different spending budgets for his/her subordinates. That reduces the risk very much

Gold rocket | satoshi club:

I liked this use case👍 Many thanks! Would you like to add something else? Or can we proceed to the next question? 😊

Thi | Polkafoundry | co-founder & ceo:

Next, please.

Gold rocket | satoshi club:

Q4 from telegram user @lzamg

One of the solutions that Polkafoundry brings to its users is the flexible payer, an application to pay transaction fees in a decentralized manner. Can you mention the issues that this feature aims to solve? How does work exactly the flexible payer and what are its functions?

Thi | Polkafoundry | co-founder & ceo:

Ok, I’ll explain this. When you guys use any DAPPs, you have to have some coin to pay the transaction

For normal users, it is hard to go to the exchange to buy coins just to try an app. So, with the flexible payer, a DAPP can pay transaction fees for users, if it decides so. This will lead to a much more natural and flexible monetization strategy for DAPPs

Such as: free, trial, pay to unlock, in-DAPP-purchase. The DAPPs can pay for users who satisfy some conditions (these conditions may be set to the contract through oracle services)

Mary | satoshi club:

That’s great functions!

Thi | Polkafoundry | co-founder & ceo:

Our blockchain support this natively, as the user can specify who pays the fees when sending transactions

Gold rocket | satoshi club:

Cool feature!👏👏👏

Thi | Polkafoundry | co-founder & ceo:

And the blockchain will ask if the smart contract agrees to pay. Kind of that It is hard to explain technical stuff here in a short time though 😃

Mary | satoshi club:

They can switch on/off these functions?

Thi | Polkafoundry | co-founder & ceo:

Yes, it is the developer’s decision.

Mary | satoshi club:

I mean they can pay for users from the beginning and then when they have enough users they can switch off this, right?

Thi | Polkafoundry | co-founder & ceo:

Yes, or they can let you use free first

Gold rocket | satoshi club:

Sounds good!

Thi | Polkafoundry | co-founder & ceo:

And after you reach a limit, or want to unlock/use an advanced feature, the contract will refuse to pay

Mary | satoshi club:

Got it! Really great feature! I want more apps to use it, because, as you stated we can’t try a lot of apps now.

Thi | Polkafoundry | co-founder & ceo:

And you have to pay yourself to use it.

Mary | satoshi club:

Ready for the next question?😀 or you want to add something?

Thi | Polkafoundry | co-founder & ceo:

Think of this scenario.

Gold rocket | satoshi club:

Thanks for the clean answer! Ready for the next one?

Thi | Polkafoundry | co-founder & ceo:

You pay using credit cards or other traditional means.

Mary | satoshi club:

Yes.

Thi | Polkafoundry | co-founder & ceo:

And an oracle sets the payment info into the contract, Then the contract will pay the transaction fee for you.

It is just an example

Mary | satoshi club:

It’s a paradise 😂

Gold rocket | satoshi club:

This is a fairly elegant solution. 😁

Mary | satoshi club:

I hope everything will be easy with apps soon and thus will also help mass adoption of crypto

Thi | Polkafoundry | co-founder & ceo:

I hope so,

Mary | satoshi club:

Ready to proceed? 😀

Gold rocket | satoshi club:

Can we proceed to the next question? 😊😉

Thi | Polkafoundry | co-founder & ceo:

Sure

Gold rocket | satoshi club:

Q5 from telegram user @keymers

He points out that “Polafouindry can create borderless and frictionless DeFi applications, as well as take DAAPs to other horizons”, if so, why among the applications that can be built does not indicate game applications? Don’t you have those characteristics? Or is it not important?

Thi | Polkafoundry | co-founder & ceo:

Games are great. It is possible to develop games on our platform. Most games use NFT and NFT marketplaces are also one of our focused use cases.

However, we are trying to attract DeFi apps, so we ask the DeFi developers what they need and try to provide them with what they need. So it is just DeFi is our number 1 priority now.

Mary | satoshi club:

So, the main focus DeFi, right?

Thi | Polkafoundry | co-founder & ceo:

We cannot focus on too many things

Mary | satoshi club:

I got you.

Thi | Polkafoundry | co-founder & ceo:

Yes, that’s it

Mary | satoshi club:

But there a lot of DeFi like games, so I think you will get some😉 When you’re planning to go live on polka?

Thi | Polkafoundry | co-founder & ceo:

Yeah, games often involve selling virtual assets, like nft, marketplaces, etc.

The first version of EVM-compatible parachain built on the substrate is planned for the end of this month for testing purposes

Mary | satoshi club:

Or even better if you will share your roadmap with us😀

Thi | Polkafoundry | co-founder & ceo:

We are now grabbing some famous Ethereum smart contracts, like Kyber’s and Uniswap’s, to put on our system and test to ensure they work flawlessly

Mary | satoshi club:

Wow, it’s so close!

Thi | Polkafoundry | co-founder & ceo:

We will launch mainnet in q3 2021

Here is the roadmap thing

Mary | satoshi club:

This year will definitely be hot for Polkafoundry 🔥

Gold rocket | satoshi club:

Hot 2021🔥

Mary | satoshi club:

Ahaha! Ready for the next question?

Thi | Polkafoundry | co-founder & ceo:

Yep

Gold rocket | satoshi club:

Q6 from telegram user @cleotilde1

I have never participated in an NFT auction but I have heard that they are very good, Polkafoundry also has auction systems. How does Polkafoundry plan to attract artists, musicians and collectors to your auctions? What is the future of Polkafoundry in terms of this type of market?

Thi | Polkafoundry | co-founder & ceo:

We do not have any built-in auction system. It is left for 3rd parties and DAPPs to implement.

Mary | satoshi club:

Oh, I think @cleotilde1 misunderstood something

Thi | Polkafoundry | co-founder & ceo:

For NFT marketplaces, it is good to have an auction to sell rare and precious items

Mary | satoshi club:

But maybe we missed some points in our discussion which you want to share with our community?

Yes, most marketplaces have this system 😀

Thi | Polkafoundry | co-founder & ceo:

There is a partner building an NFT app on our platform, but they focus on the NFT marketplace first and auction next phase. I think it is definitely can be done at the DAPP level.

Mary | satoshi club:

I think it will be attractive for users! NFTs becoming very popular now. Btw, can you tell us the name of this partner or it’s a secret?

Thi | Polkafoundry | co-founder & ceo:

We will sign a partnership, so let’s save the news or the marketing team will kill me …

Gold rocket | satoshi club:

Lol😂

Mary | satoshi club:

No, I want you to stay alive 😂 So, we will follow the news in the name of your life😂

Gold rocket | satoshi club:

When it’s known, don’t forget to share it with Satoshi Clubbers.🙏

Mary | satoshi club:

But I think that the marketing team will only thank you if you will answer our live part questions 😀 you always give very detailed and interesting answers. Ready for a live part?

Gold rocket | satoshi club:

@thi_pkf before the most impressive part of ama, you can share useful links and information with our community🙂

Thi | Polkafoundry | co-founder & ceo:

Okay.

Mary | satoshi club:

Hold your umbrella ☔️, we will have a storm now. Now we’re ready for the live part and…let’s go 🚀

PART 2.Questions about the PolkaFoundry project from the live chat of the telegram community.

In this part, we open a chat for the crypto community for 120 seconds. Then the guests from the PolkaFoundry crypto project choose the top 10 questions. The 10 crypto enthusiasts have earned cryptocurrency in the sum of 100$.

Q – 1 from a telegram user @moonhold

You said Polkadot is good for migrating existing dapps from Ethereum so is the main focus of the project allowing other projects to move from Ethereum blockchain into polka?

Thi | PolkaFoundry | Co-founder & ceo:

No, migration dapps from Ethereum is a good start, but it is never the destination.

We want to create a environment where developers and experiments and try new things that is not possible with ethereum due to many constraints about cost, speed, interoperability, and UX.

You can build new apps from scratch, or migrate from other chains. PolkaFoundry will unleash developers to explore new horizons of DeFi (that are words of our marketing team, but it is our vision

.Q – 2 from a telegram user @cryptofollower

On your website, it says your platform has automated loan decisions but for this won’t you need our wallet private keys?

Thi | PolkaFoundry | Co-founder & ceo:

No way. No-one needs your private key except yourself. By automate loan decision, we mean the lending platform has more info automatically decide whether to accept your loan requests

Q – 3 from a telegram user @mobilejii

Hello!

✅ anonymous team projects cannot be trusted like a public team, can you tell us more about team background, and are there any chance to remain public in the future?

Thi | PolkaFoundry | Co-founder & ceo:

Our team is public and transparent. You can see it on our website

Q – 4 from a telegram user @topind7

As a very young and new project, how can you convince crypto users that your project is a project with lots of potentials and what competitive, unique or advantageous features do you have that will attract investors from your users?

Thi | PolkaFoundry | Co-founder & ceo:

We’ve been in this industry for several years, it is a 2.5 years project, rebranded and refocus.

The Polkadot ecosystem is still very young but very potential.

We have years working on the blockchain with real hands-on experience and many products. We have a strong team and technical resources.

We contracted with top blockchain marketing firm.

We are backed by top VCs and partners to accelerate quickly forwards.

We have our own innovations, especially in UX for dapps features.

That’s what differentiates us and why the community can trust us.

Q – 5 from a telegram user @Wormz28

I got interested on your Utility Features about ASSET INHERITANCE. It’s so amazing that PolkaFoundry allows a person to set others as their inheritors. So to overcome this drawback, how will the inheritors activate the inheritance workflow to claim his/her inheritance rights? How’s this works really? What’s the process, like is there documents needed to submit?

Thi | PolkaFoundry | Co-founder & ceo:

When a person, unfortunately, passes away, for example in an accident, it is likely that his fund is lost. No inheritance is possible if no-one knows the private key.

We want to address this issue. It works like this.

Every account can add others (for example, their children) as inheritors, and config inheritance parameters for each inheritor.

After the account owner is inactive for a predefined period of time, the inheritors could claim their inheritance right.

Then it goes into the challenge period. The account owner could reject (if he is still alive, of course. And 3rd person or verification service delegated by the owner must also verify if the account owner requires so.

After the challenge period, if everything was settled, the inheritor can withdraw the inherited fund.

Q – 6 from a telegram user @KhaleesiTheCryptoLady

Just found out that PolkaFoundry has 2 Telegram Groupchat (1) @polkafoundry_chat and (2) @PolkaFoundry, which one is your official group? How will you warn users about this duplication especially of collecting money from another group?

Thi | PolkaFoundry | Co-founder & ceo:

@PolkaFoundry is the official group, and we have 2 regional groups:

Vietnamese: @polkafoundry_vi

Korean: @polkafoundrykor

Other groups are fake and scam. Please help us to report.

Q – 7 from a telegram user @csgonub

Do you have a head office and all you guys working together at Singapore?

Thi | PolkaFoundry | Co-founder & ceo:

Yes, the head office registered in Singapore, but the tech team is mostly in Vietnam. The marketing team is in Canada, India, Japan. We have our own office (not co-working space) which is startup style

Q – 8 from a telegram user @lzamg

PolkaFoundry provides a particular type of smart contract called “decentralized bot” that responds to users’ queries. Can you explain more details about all the possible functionalities of this bot and what it can do for users? In which cases would this bot be convenient and useful?

Thi | PolkaFoundry | Co-founder & ceo:

Because for current smart contracts, it is hard for users to interact with them. Users have to interact with dapps through the app (web or mobile). In the end, most users don’t know what contract they are interacting with.

The decentralized bot is a special kind of contract, with a defined convention, so you can chat with it from within your wallet without the need for any website or app. It is similar to the telegram bot. Conversational UI is interesting.

Q -9 from a telegram user @ronaldo_super

The signing key says it has an expiry time so what happens when it expires can I create a new one with my private key?

Thi | PolkaFoundry | Co-founder & ceo:

Yes, you can “refresh” it with your private key

Q -10 from a telegram user @tarkata0420

Why you select grabbing ethereum smart contract kyber and uniswap have you another blockchain system

Thi | PolkaFoundry | Co-founder & ceo:

We just want to use some complicated contracts out there to see if they work on our platform.

You see, it is easy for a simple contract to work. But for complex ones, if it works, it proves that the compatibility level of PolkaFoundry is very high.

Part 3 – Quiz about project

In the final part, we tested the knowledge in terms of the PolkaFoundry project. They’ve prepared 4 questions for this part, so everyone could be a part and answer. Participants had 10 minutes to answer. 600$ was distributed between the winners.

Our contacts for more details:

English Telegram group | Russian Telegram group | Spanish Telegram group | Telegram Channel | Twitter | Website

Our Crypto Partner by this AMA: PolkaFoundry

Telegram group | Telegram Chanel | Tweeter | Website | Medium