Hello,

Satoshi clubbers! Another AMA took place in Satoshi Club and we would like to

introduce to you the AMA session with our friends from SafeEarth and our guests

were @TheCryptoMartian @popelit @KenSafeEarth. The AMA took place on 28 April.

The

AMA session was divided into 3 parts with a total crypto reward pool of 500$

In

this AMA Recap we will try to summarise the most interesting points for you.

Part

1 — introduction and questions from the Telegram community

Mary

| Satoshi Club: Hello Satoshi Club! We are happy to

announce our AMA session with SafeEarth! Welcome to Satoshi Club😀

D.

| Satoshi Club: today our guests – @TheCryptoMartian @popelit @KenSafeEarth !

welcome to Satoshi Club guys!

Ken

SafeEarth – SafeMars CEO (won’t DM first): Hello everyone

🙂

The

Martian (i will NOT dm you first, if so it’s a scammer):

Hello world! Thanks for having us 😘

Mary

| Satoshi Club: Hello guys 😊 Welcome to Satoshi

Club! how’s going?

Ken

SafeEarth – SafeMars CEO (won’t DM first): For those of

you who don’t know us, we are SafeEarth it’s great to be a part of the Satoshi

Club and are here to answer any questions you may have about us 🙂

The

Martian (i will NOT dm you first, if so it’s a scammer):

Stoked to be here to tell you about us

Mary

| Satoshi Club: And we want to know as much as possible

😉

So🚀🚀🚀

Let’s start with intro 👍

Could you please introduce yourself and tell us more

about SafeEarth?😉

Ken

SafeEarth – SafeMars CEO (won’t DM first): SafeEarth – we

are the same team behind SafeMars –

Yesterday we marked a big milestone in the SafeEarth planner. We are

officially 1 month old.

Mary

| Satoshi Club: Happy birthday 🎉💐

D.

| Satoshi Club: okay, so what is SafeMars then 😄

Ken

SafeEarth – SafeMars CEO (won’t DM first): My name is Ken

and I’m the CEO 🙂 nice to meet everyone

here at the Satoshi Club! Thank you again for having us

We are a Autonomous yield and liquidity generation

protocol. Simply hold SAFEEARTH in your wallet and you will get more. On each

transaction the protocol automatically distributes rewards to holders as well

as auto-locks liquidity forever.

The

Martian (i will NOT dm you first, if so it’s a scammer):

I’m the original developer of SafeEarth (and SafeMars shortly before it). In

the meantime I’m happy to say we’re 15 people, devs, marketing, admin, not to

mention the army of tireless mods in our groups 😜

Mary

| Satoshi Club: How long are you in crypto, Ken?😀

Ken

SafeEarth – SafeMars CEO (won’t DM first): Me since about

2014 🙂

The

Martian (i will NOT dm you first, if so it’s a scammer):

So, we have two tokens:

– SafeMars: on Binance Smart Chain (BSC)

– SafeEarth: on Ethereum (ETH)

We call them “sister” tokens. Even though

today’s AMA is about SafeEarth, feel free to ask SafeMars questions as well if

you have them.

Mary

| Satoshi Club: 👍

Ken

SafeEarth – SafeMars CEO (won’t DM first): SafeEarth is

programmed to reward holders while increasing in both liquidity and value. It

does this by applying a 4% tax on transactions.

D.

| Satoshi Club: 15 people are lot, for the young

project, when your team was formed?

Mary

| Satoshi Club: Yes, that’s nice👍 good

incentive

Ken

SafeEarth – SafeMars CEO (won’t DM first): part of that

tax is used as follows:

1% goes to holders (instantly without fees) 😁

The

Martian (i will NOT dm you first, if so it’s a scammer):

It still amazes me how the team came together organically. I started myself and

right after launch several people expressed interest to contribute. I basically

took everyone on board: some were devs, some were mods, some were

videographers, some marketing people. Even though we didn’t do any

“interviews” 😊 absolutely everyone on the team is awesome! I

think by the second week we more or less had the team we have now, with just

1-2 people joining after.

Ken

SafeEarth – SafeMars CEO (won’t DM first): 1% is locked

into liquidity forever(allows trading)

Mary

| Satoshi Club: I have one question – if your coin is

programmed to reward holders, why should they make transactions?😀 If

everyone will hold and any transactions will happened what then?

Ken

SafeEarth – SafeMars CEO (won’t DM first): That’s a very

good question but part of the tax is also used for the following reasons, I

have explained above the 2%

another 1% of that goes towards the Earth Fund.

SafeEarth’s incentive is to help our planet and all

those who live in it, by trading our token holders are also donating to charity

to make the world a better place for us all

I won’t give the total amount we have donated just

yet as that’s part of the quiz to come

The

Martian (i will NOT dm you first, if so it’s a scammer):

To add to what Ken said. I think that even though we incentivize holding,

people will always trade. To get holder rewards you have to buy in the first

place, the more people buy the more some holders will take profit, then the

cycle repeats.

This cycle is good for everyone: holders, sellers,

charity donations and project funds for marketing 😜

Mary

| Satoshi Club: Sure! But i think it’s like “those

who read AMA carefully will perfectly answer Quiz”😀

Yes, i got this👍

Thank you for your intro, guys!

Ready to start with the questions from our

community?😀

Ken

SafeEarth – SafeMars CEO (won’t DM first): and the last 1%

of the tax is spent on outreach and marketing!

Sure thing 🙂

Q1

from Telegram user @victorogb

SafeEarth

is a pretty new project officially launched on the 27th of March 2021, and in

that short time frame (approximately a month), it has successfully supported a

foremost charity programme and raised close to $200,000. This is really an

astronomical feat by all standards. I will glady like to know how SafeEarth was

able to achieve this within such a short period after launch and going forward,

how will SafeEarth maximise the enormous potentials of her growing community in

building a safer and better planet?

Ken

SafeEarth – SafeMars CEO (won’t DM first): Yes we are just

1 month old, in that short space of time we have achieved this though our

amazing community. Growing the community and becoming more recognised in the

charity sector is what we main to be. We will maximise our potential by getting

directly involved with charities and completing projects with individuals to

help communities. For example: We have now started to do some work with The

Water project to build some wells in parts of Africa. This was all possible to

our community and our holders who trade our token

The

Martian (i will NOT dm you first, if so it’s a scammer):

Just a mention from my side: we donated almost $200k so far and in the meantime

the EarthFund (as we call it) accrued almost that amount again (at today’s ETH

price) which means our next donation will be at least $200k (most likely more

by the time we do it), bigger than both our two previous rounds together 🎉

Mary

| Satoshi Club: Btw, i want to ask if you had a charity

experience before?

Incredible numbers! 🎉

Ken

SafeEarth – SafeMars CEO (won’t DM first):I have done

volunteer work before yes in the UK 🙂 I love giving back to the community and

with SafeEarth I honestly believe we can make the planet a better place for us all 🙂 –

As the Martian pointed out those numbers are amazing 🙂

Mary

| Satoshi Club: How legit will be this donations? As i

know not all charity funds accept crypto😀

The

Martian (i will NOT dm you first, if so it’s a scammer):

On a personal note: our last donation round was done live on telegram with

representatives from the charities coming in and saying some words about what

they do and how this money impacts and helps. It was an incredibly emotional

and satisfying moment to be able to be part of that. I invite everyone to join

us for the next one ☺️

Mary

| Satoshi Club: Sure, i can only imagine 😀 hope

i won’t be late to see how your next round will go!

Ken

SafeEarth – SafeMars CEO (won’t DM first): Whilst not all

charities currently accept crypto you would be surprised how many of them are

now starting to do so. Its because of projects like ours they are starting to

do so. All our donations are done live on our Telegram group. In the near

distant future we hope to do them by live video streamed on our YouTube Channel

The

Martian (i will NOT dm you first, if so it’s a scammer):

All charities we donated to so far accepted crypto. The bigger ones even have a

way to do it directly on their website, the smaller ones have a donation

wallet. Most take anonymous donations. For those that don’t, members of our

team that are public donated from our funds. All transactions are public on the

blockchain and links can be found on safeearthcrypto.com 😜

Mary

| Satoshi Club: Awesome 👏👏👏 we

got a lot of new info!

Thank you for your answers! Ready to proceed?🚀

Ken

SafeEarth – SafeMars CEO (won’t DM first): Always 🙂

Q2

from Telegram user @pixma00

How

are the charities selected to which the money will be donated? How are the

various donations distributed? In the case of active tokens, will the Hodlers

have to pay any gas fees to get their rewards? Under which chain do your

transactions operate?

Ken

SafeEarth – SafeMars CEO (won’t DM first): We have

currently done 2 donations, Our first donation was chosen by the popular vote

of our community. this was a at the time a $100k Donation which was sent to

TheOceanCleanUp. For our second round of donations that happened on Earth Day –

we decided to split the funds and reward 4 different charities. These Charities

were chosen by the wider community and discussions in our official Telegram

Group. Holders do not pay any gas fees to get their rewards as 1% goes back to

holders instantly and without fees. We operate only under the Ethereum

blockchain and UniSwap

The

Martian (i will NOT dm you first, if so it’s a scammer):

To clarify: there is a SCAM SafeEarth token on BSC. Has no relation with us, DO

NOT BUY!

Mary

| Satoshi Club: That’s important 📌

D.

| Satoshi Club: good info! thanks!

Ken

SafeEarth – SafeMars CEO (won’t DM first): Our Earth fund

has accumulated another 70 Ethereum which will be donated again soon to

charities. We will be releasing further information on our social media

channels regarding our next donation 🙂

Mary

| Satoshi Club: So, you will continue to vote in your

tg group or may be you are thinking to create another voting system?

Huge amounts! Incredible!

Ken

SafeEarth – SafeMars CEO (won’t DM first): At the moment

yes we will be allowing the community to present ideas regarding charities and

then put it to a vote 🙂

It is amazing 🙂 we have come such a long way in

just a month and we have such a long way to go!

Mary

| Satoshi Club: 👏

Thank you for your answers, guys! Ready to jump to

the next question?😉

Ken

SafeEarth – SafeMars CEO (won’t DM first): Please, proceed

🙂

Q3

from Telegram user @yellowchamp

I

heard about SafeMoon ,SafeMars projects already in the market and now we have

SafeEarth. So my question is, does SafeEarth have any connection with those

mention projects? As many coins or tokens in the market that shows a good

impression at first but as time goes by they have been rugged even many holders

already, so how can we trust and believe that $SAFEEARTH will be a great

project and a good investment for a long run? Thank you

D.

| Satoshi Club: so we have heard about SafeMars

already, what about SafeMoon? 😄

The

Martian (i will NOT dm you first, if so it’s a scammer):

We have no relationship with other SafeX projects, only SafeMars and SafeEarth.

As far as the “safe” part goes, we

technically cannot rug:

– liquidity is locked on team finance (all

transactions public)

– as more liquidity is auto-generated by our smart

contract we lock it as well (every couple days)

– we’ve been audited by Hacken (audit available on

safeearthcrypto.com)

– and last but not least….the fact that we’ve

donated almost $200k to charity and are about to donate at least $200k more should

speak for itself

We’re in this for the long run 😜

D.

| Satoshi Club: do you have any strategy on bear

market? it will come sooner or later, do you already discussed with the team,

how you will be survive?

Mary

| Satoshi Club: That’s great, team finance is a good

choice! What about smart contract audit?

The

Martian (i will NOT dm you first, if so it’s a scammer):

You can download it here: https://safeearthcrypto.com/pdf/SafeEarth_SC_Audit_Report.pdf/

Mary

| Satoshi Club: No issues! Great job👏

The

Martian (i will NOT dm you first, if so it’s a scammer):

We always plan for a rainy day. 1% of transactions goes towards our marketing

fund and should the bear market come, we’re ready to use a part of that for

further development. However, we’d probably have a community vote. It was the

community actually who voted to use 1% for marketing 😜

Ken

SafeEarth – SafeMars CEO (won’t DM first): We have a few

things up our sleeve, pushing harder than ever with marketing from our fund and

providing the community with personal updates from myself. There is always

light at the end of the tunnel if things do go that way. We are a very strong

and dedicated team 🙂

It seems my touch typing skills are not up to the

Martians 🙂

D.

| Satoshi Club: [ 💪 Sticker ]

thank you guys for answers! 😊

ready for the next question?

Ken

SafeEarth – SafeMars CEO (won’t DM first): Sure thing 🙂

Q4

from Telegram user @meml97

It

came to my attention on your roadmap that for Q2 2021 you have “Community

votes, events and competitions”. Can you tell us more about this? On what will

users be able to vote at that time, and how? Also, can you share more about

those events and competitions? What will they going to be about and what will

SafeEarth and its users get from both things?

Ken

SafeEarth – SafeMars CEO (won’t DM first): Absolutely! On

our second donation, we had a live music event streamed for our holders live on

our website. We always what’s best for

the community and in order to do, we allow everyone to share their opinions and

come forward to us on how we can make SafeEarth a better, stronger community

Furthermore…

We have already had our first challenge, The Plastic

Challenge in which we handed out over $3600 worth of tokens just for collecting

and recycling plastic

In the future we hope to have even bigger

competitions with even bigger prices for completing tasks that help our

communities and our planet.

D.

| Satoshi Club: so for the process of voting, i want

clarify, to be able to vote person should hold some amount of your tokens?

Mary

| Satoshi Club: Creative and important event👍

Ken

SafeEarth – SafeMars CEO (won’t DM first): In terms of

voting for the donations, we have a personal vote in our Telegram group and

then a public vote on twitter.

But we encourage all people that vote to be holders,

our first vote was public on twitter so technically no you wouldn’t have to

hold tokens to vote. But this may change at a later date.

Mary

| Satoshi Club: Awesome! Great job, guys, don’t stop! 😀

do you want to add something or we can go to the next question?

Ken

SafeEarth – SafeMars CEO (won’t DM first): Do proceed 🙂

Q5

from Telegram user @Winner_don

On

dexguru, i saw two variant of SafeEarth; the erc and another BSC. Also, on

pancakeswap, if you search SafeEarth, you wil see SafeEarth token. I know

SafeEarth to be available only on Uniswap but seeing SafeEarth on Pancakeswap

made me confused. I want to ask if the Safeearth on BSC is legit? Also, i

bought some on BSC and notice the price far lower than the one on ERC-20. What

can you say about the Safeearth on the BSC network? The trading volume is over

$1000.

D.

| Satoshi Club: we already touched this question today

The

Martian (i will NOT dm you first, if so it’s a scammer):

The one on BSC is a scam, do not buy.

D.

| Satoshi Club: any plans to launch official token on

BSC?

The

Martian (i will NOT dm you first, if so it’s a scammer):

Yes, SafeMars 😜

Ken

SafeEarth – SafeMars CEO (won’t DM first): the BSC Token

is A SCAM PLEASE DO NOT BUY – We only trade on the Ethereum chain as The Martian

pointed out 🙂

D.

| Satoshi Club: 😉 gotcha😄

Mary

| Satoshi Club: What is SafeMars project about? Which

goals it has?

D.

| Satoshi Club: i think this is a part of

decentralization as well, that anyone can create scam token with a similar name

on other platform. tough to solve this issue at the moment 🤷

Mary

| Satoshi Club: Scammers never sleep

Ken

SafeEarth – SafeMars CEO (won’t DM first): to find out

more about SafeMars you can visit our website at www.safemarscrypto.com 🙂 we currently have 350k holders and I’m

positive SafeEarth will follow its its footsteps

D.

| Satoshi Club: insane amount of holders 👍

The

Martian (i will NOT dm you first, if so it’s a scammer):

SafeMars is our first project. It’s on BSC and we like to say “we pay you

to hold” 😊 Basically you hold SafeMars and as people transact you

get more automatically in your wallet.

As it gained traction quite well, the trading volume

is high so it really “pays” to hold it.

Another component is the auto-liquidity generation,

same as SafeEarth, but dialed up 1%, so 2% of each transaction gets

automatically added to liquidity. Our current liquidity is at $13 million.

Ken

SafeEarth – SafeMars CEO (won’t DM first): It is indeed

very sad..its not something we can control. What we can do is spread awareness,

use our strong community to report their fake channels so that people don’t get

scammed.

D.

| Satoshi Club: that’s right 💪

Mary

| Satoshi Club: Yes, i see😀 you even plan NFT

farming soon! Very interesting project

Thank you for your answers! Ready for the 6th and

last question from this part?😉

D.

| Satoshi Club: good question for the second part, so

Satoshi clubbers this is your chance to ask them about NFTs😄

Mary

| Satoshi Club: You’re good in hints😉

Ken

SafeEarth – SafeMars CEO (won’t DM first): yes please 🙂

Q6

from Telegram user @kimzyemma

In

your roadmap, you stated there that FURTHER PARTNERSHIP in Q2 2021, I haven’t

seen or read about any of your partnership at all. Since you said further

partnership in second quarter, that shows you have partnered with some which

are not listed on your website. The community will be interested in knowing

companies SAFEEARTH has partnered with.

Ken

SafeEarth – SafeMars CEO (won’t DM first): We are always

expanding our team the people we are working with. We will be partnering up

with some of our previous charities that

we have worked with as well as expanding into other advertising ventures such

as TV. This is all in the pipeline to expand SafeEarth into the wider non

crypto related community.

The

Martian (i will NOT dm you first, if so it’s a scammer):

Good point. Our website is constantly being updated. We have several

partnerships in the works. I can’t reveal too much but they go along the

following lines:

1. Partnerships with charities. This would mean we

donate to them regularly (not the whole donation amount of course, we want to

always donate to new ones as well) and work closely together where they also

give back updates how the money is spent so we can keep the community up to date.

2. Technical partnerships: for example for SafeMars

we partnered with The Token Kennel for staking and Degenr for NFT mining. We

aim to do something similar for SafeEarth.

3. Marketing partnerships: as Ken said we aim to

make SafeEarth known to the general public (also outside of crypto) and for

that we’re going to partner with some well known influencers, media outlets as

well as the electronic music scene 😜

Also to mention: we’re always open for new ideas and

feedback. If you want to partner with us or know someone who does, please do

reach out.

Mary

| Satoshi Club: Fantastic speed😀 we will follow

your updates and will be waiting for new partnerships announcments👍

Part

2 — live questions from the Telegram community

Q1 from telegram username @Josichams

What motivated you to carry out this project and

include saving the planet🌍?

SafeMars

CEO (won’t DM first): Helping others has always been a passion of mine.

Everyone should have the access to clean water and basic needs which sadly not

many of us do. Hopefully with SafeEarth we can make a BIG change.

The Martian (i will NOT dm you first, if so it’s a

scammer): I’m going to coalesce

several questions into one answer:

– where to find the

real token to make sure I don’t buy the fake one?

– which charities did

you donate to and where is the evidence?

– do you have any

project to help water shortage in Africa?

– what % is given to

donations?

Please go to

safeearthcrypto.com and you will find the answers to all of these questions

there, in far greater detail than I could write here.

Q2 from telegram username @amozee77

When will Safe Earth token be listed on any

exchange?

The Martian (i will NOT dm you first, if so it’s a

scammer): We will list on

BitMart. Target is the next 1-2 weeks.

Q3 from telegram username @cindy_crypto

How is it possible to distribute tokens to token

holders? I mean if I hold your token and you distribute to the holders, will my

tokens number increase?

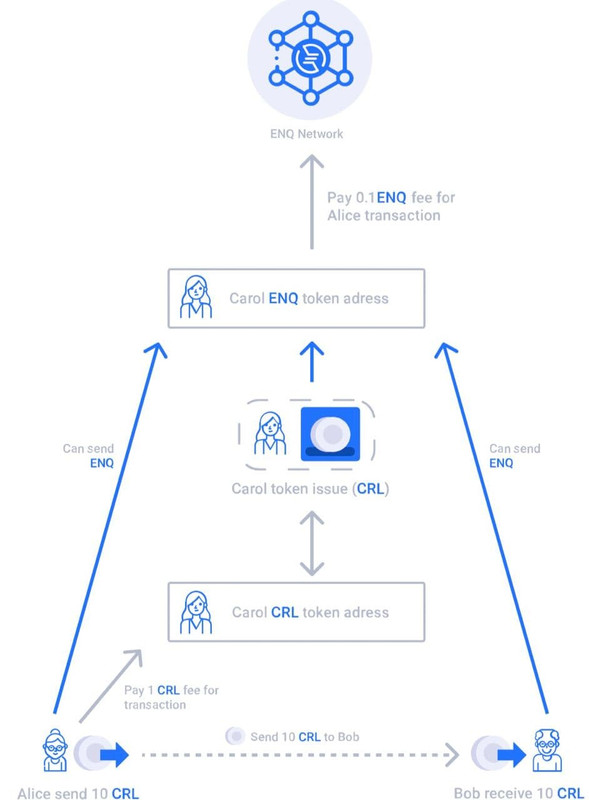

SafeMars CEO (won’t DM first): The genius tokenomics uses the same tax mechanism

to reward holders, feed the Earth Fund, pay for marketing, and drive deflation

of the token’s supply, increasing its scarcity and thus its value. 1% of each

transaction will go back to holders without any fees. (no gas fees)

Q4 from telegram username @Manugotsuka

⭕️ Considering that Safe Earth was made to help

others, how do you generate your own profits to keep growing everyday ? In

other words, who help you?

The Martian (i will NOT dm you first, if so it’s a

scammer): 1% of each transaction

goes towards a marketing fund. This helps us finance our work.

Q5 from telegram username @boradam

You told us there is SCAM SafeEarth token on BSC.

I’m worried to buy the fake one. How can I find the real version?

The Martian (i will NOT dm you first, if so it’s a

scammer): Always on safeearthcrypto.com

Q6 from telegram username @Ambbobb

You said another 1% of that goes towards the Earth

Fund. What is Earth fund and its purpose?

The Martian (i will NOT dm you first, if so it’s a

scammer): EarthFund is the name

we gave our wallet which accrues 2% of taxes:

– 1% will go to

donations

– 1% will be used for

marketing and project development

Q7 from telegram username @Mamitabella

Your token has Burning about how often?

SafeMars CEO (won’t DM first): We burned over 50% of the total supply during our

launch, sending these tokens to our black hole address. This address continues

to receive its share of the 1% distributed to holders from each transaction,

constantly removing more tokens from circulation. With no limit to this burn,

the black hole continues to grow, ever-increasing the scarcity of SafeEarth.

Q8 from telegram username @JoanaZ

➡️ How do you select the charities

that the platform R? There is needed pass a filter to prevent scammers?

The Martian (i will NOT dm you first, if so it’s a

scammer): Good question. We

sadly had A LOT of scammers trying to get donations. It’s sad, but true, that

some people would scam money destined to save children or provide water to

people not having access to it.

We check each charity

and TALK TO THEM on the phone! During our last donation round we even had

representatives from the charities join us live on telegram to share their

mission.

Of course, none of thes

checks is absolute, so we also rely on the community to help us out by

suggesting legit charities to donate to in the first place and also checking

the ones we chose.

Q9 from telegram username @KhaleesiTheCryptoLady

How will SafeEarth save our mother Earth from

disasters created by humans? Do you support charities that aims to save mother

Earth? 😊

SafeMars CEO (won’t DM first): This is the reason we exist 🙂 if you have any

charities you would like us to support in the future that are aiming to help

our planet, please do let us know! Saving the planet though investment.

Q10 from telegram username @Hukaeabc

Would you agree with everyone that community is

everything? How important is the community to you? How can we collaborate or

help you to develop the project?

The Martian (i will NOT dm you first, if so it’s a

scammer): Yes, we completely

agree. Both SafeEarth and SafeMars are community project. That is: there is a

core team working on them, but we can’t do it alone, we need everyone’s help.

How can you help? There

are many ways:

– you can spread the

word about the project, what it does and what its mission is

– you can join our

telegram channels and help with any ongoing events (such as votes in various

places to make us known)

– you can research

charities and suggest them to us

– if you’re a developer

you can help with development (just today someone from the community launched

an awesome WearOS clock face 😊)

– and of course any

ideas you might have! Share with us, the team will help wherever we can.

Part 3 – Quiz Results

As usual, for the third

part, Satoshi Club Team asked the chat 4 questions about the crypto project. A

link to a Quiz form was sent into the chat.

For

more information and future AMAs, join our Social Media channels:

English Telegram group: https://t.me/Satoshi_club/

Russian Telegram group: https://t.me/satoshi_club_ru/

Spanish Telegram group: https://t.me/satoshi_club_spanish/

Telegram Channel: https://t.me/satoshi_club_channel/

Twitter: https://twitter.com/realsatoshiclub/

Website: https://esatoshi.club/

Our

partners:

Telegram: https://t.me/SafeEarthETH/

Twitter: https://twitter.com/SafeEarthETH/