Today in Satoshi we had Club thematic guests – in the middle of winter our friends from NORD Finance visited us. And now we would like to tell you about this AMA session. The AMA took place on January 10 and our guestwas Amarnath CEO of Nord Finance.

The total reward pool was 1000$ and has been splitted in 3 parts.

In this AMA Recap we will try to summarise the most interesting points for you.

Part 1 — introduction and questions from the Telegram&Bitcointalk community

Luis Merino | Satoshi Club: Hello SatoshiClubbers! Welcome to another AMA session with us. Today we have Nord Finance. @amarnath_reddy welcome!

Amarnath | Nord Finance: Hello Everyone , thank you for inviting me here . Glad to be here !

GoldRocket: Good evening, dear community! We are delighted to welcome our guest from Nord Finance. Greetings @amarnath_reddy! Welcome to Satoshi Club!

Luis Merino | Satoshi Club: Can you please tell us a short intro about yourself and how did you get involved in Nord Finance? 🙂

Amarnath | Nord Finance: Sure. My self Amarnath CEO of Nord Finance , I have been into crypto since 2017 end, the exact last bull run. I was fascinated by the technology and volatility of the industry, we then Co-Founded Amesten Asset (crypto Hedge fund) along with Sachin jain, taking care of operations and Research analyst for early-stage blockchain startups.

After leaving from Amesten in Sept 2020 , I have Co-founded Nord Finance along with @jigneshvasoya who is lead Developer at Tezos India Foundation , he also worked on financial platforms with Ethereum & Hyperledger Fabric. Jignesh and me know each other for quite sometime and we have been exploring DeFi space for quite some time , we then came up with this idea of founding Nord Finance ( Earlier it was Slick Finance ).

Luis Merino | Satoshi Club: Maybe that bull run impulsed your interest in crypto? 😉

Amarnath | Nord Finance: Yes and happy to see Bulls are back in force !

Luis Merino | Satoshi Club: Two friends are doing business! :+1:

Q1 from Telegram User @miki_mik

What does block-chain agnostic mean? It’s the first time I encounter this term, can you tell us how does it reflect in your tech and project in general?

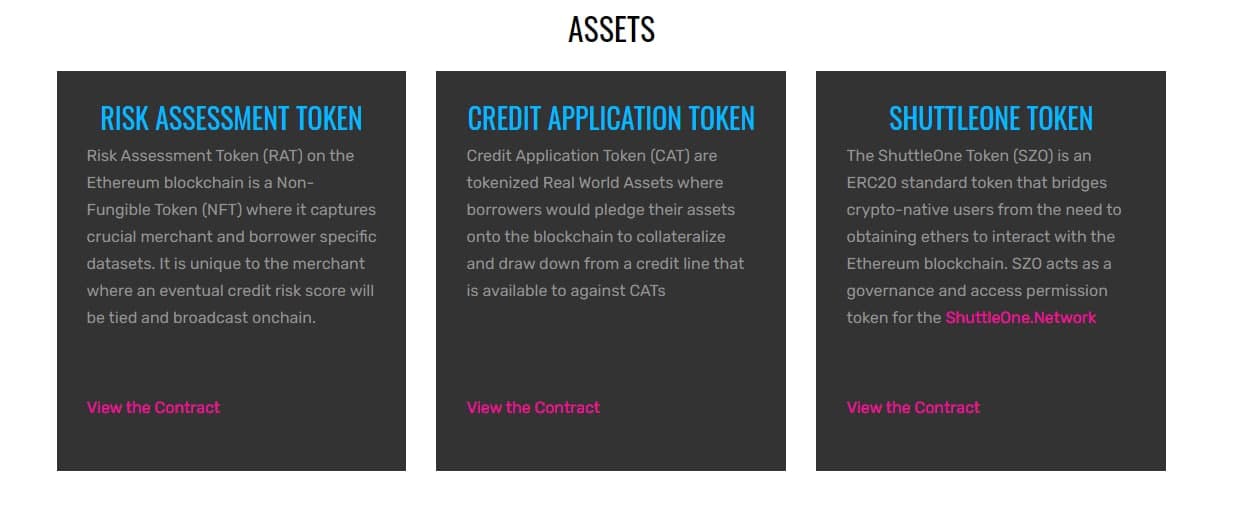

Amarnath | Nord Finance: Yes in simple terms we meant to be a cross chain Interoperable solution for the needs of users , by saying so we wanted to be onestop solution for user needs and provide access to different blockchain compatible DeFi protocols.

Nord.Bridge

Designed as a unique combination of smart contracts to

facilitate cross-chain transactions to enhance platform’s utility and

drive functionality. Therefore, there are two significant aspects to

consider to implement the use-case of the protocol – atomic

cross-chain swaps followed by cross-chain bridges.

The Atomic

cross-chain swaps facilitate token exchange from one blockchain

network to another.

In comparison, the cross-chain bridge

serves as an instant transaction mechanism across different

blockchain networks.

The Nord.Bridge mechanism allows connecting

the ERC20 contracts to other compatible blockchain and side chains

such as Binance Smart Chain, Matic Network, and others. The

Nord.Bridge is designed to deliver the best of both worlds by

promoting token swaps in real-time and depositing/withdrawing funds

across compatible blockchains. This fuels adoption as it helps

integrate seamless access to financial markets and different

financial instruments under one roof.

The Nord.Bridge and

Nord.Controllers are interoperable as the former facilitates the

latter to extract the APY details across different compatible chains.

Thus, making the process easier as all relevant data is available at

the same place in real-time.

little more explanation about this !

Q2 from Telegram User @michaelaelf

Can you tell us more about your partnership with Frontier? Why did you need a partner to develop a mobile version of your service? Or is this partnership more than this?

Amarnath | Nord Finance: The partnership with Frontier will enable access to Nord Savings on Frontier Mobile interface. Users will be able to access Nord Savings by connecting mobile wallets with the Frontier DeFi interface.

The synergy between Nord Finance and Frontier helps us build the perfect tools to make DeFi more accessible bringing us one step closer to mass adoption. Both companies share the same vision of bringing cross-chain interoperability to DeFi.

You can find more at https://nordfinance.medium.com/nord-finance-and-frontier-form-strategic-partnership-to-introduce-nord-savings-on-mobile-8e3a635850d9

Luis Merino | Satoshi Club: Go give some claps to that article guys 😉

GoldRocket: Btw in your article on Medium, you said: “The opportunities in front of us were much bigger than the goal we set for ourselves at the very beginning.” Reveal the secret of what features have become available to you and can you say that your protocol is better thought out than CURV?

Luis Merino | Satoshi Club: Are you planning some other parterships to keep developing your product?

Amarnath | Nord Finance: I think you are referring to this , we initially formed Slick Finance with the goal of only a savings product and then evolved into Nord Fiancee as a full pledged DeFi Eco System https://nordfinance.medium.com/slick-finance-is-evolving-introducing-nord-finance-5f1352a2196d

We do have few in advanced discussions and due for announcements in coming weeks. We had Zokyo announcement just couple of days back

https://nordfinance.medium.com/nord-finance-forms-strategic-partnership-with-leading-blockchain-security-and-engineering-firm-ec03babe7c58

Luis Merino | Satoshi Club: Any hints you can give us about future collabs?

Amarnath | Nord Finance: haha 🙂 , you will see them very soon . Fellow DeFi ecosystem projects who are supporting us even from early stage investments . Also may be a one or two blockchains who will be officially onboarding us ! Too much to reveal now I think 🙂

Q3 from Telegram User @aawutt

You talk about APY Maximization but don’t explain how you intend to do it. Please get into specifics, because everyone promises higher APY’s, but not everyone can deliver this.

Amarnath | Nord Finance: We have written a full article about this on our medium platoform

The Nord Savings Module is an automated tool designed to identify the best stable-coin based yield-farming strategies across blockchains. The module tracks prices, pool-wise liquidity, current & historical pool APY trends and assigns a risk-score to each strategy in real-time. Post which, the module allocates capital based on pool-wise risk-scores with the objective of delivering highest APY while following the community identified risk strategies as guard-rails.

https://nordfinance.medium.com/how-does-nord-savings-work-part-3-39e4a918c6c2

Luis Merino | Satoshi Club: As I see your Medium is full of useful information. I’ll follow it 😊 😊

Amarnath | Nord Finance: Yes they are indeed 🙂 you will sure like them and give some claps too !

GoldRocket: I didn’t understand about Zero-Cost Transactions because of the word final APY.Pooled liquidity. Is it really zero transaction cost or is the cost per transaction deducted from my final income?

Amarnath | Nord Finance: What we are trying to do is to optimize the fees of users by pooling the liquidity . Also for user to onboard onto our platform we are integrating a solution where user dont need to worry about ETH balance for paying the gas fee and at the same time contract will automatically adjust gas fees in final APYs. So its a effective zero transaction fee on the user while onboarding. Can read more about here https://nordfinance.medium.com/how-does-nord-savings-work-part-2-b70483631273

Q4 from Telegram User @Anacruzz

Raising too much money in private or seed is always a concern for small investors who participate in the public sale. This is because they buy with lower price and can easily sell with profit. So, my question is: How much did you raise in private and what is their vesting period?

Amarnath | Nord Finance: We are aware of this concern of raising heavy , due to which we set our fund raising goals to limited amount so that it will help us to run overheads at least for 2/3 years . We also make sure that our fundings are spread across many investors and fellow founders who believed in us so that immediate sell pressure from single entity wont be there . We have long vestings for the investors as well. We tried our best to balance things and raised only what is required . 510,000 $NORD is allocated to seed round investors at 0.45$. 1,590,000 $NORD are allocated to private sale round at 0.63$. Early-stage seed round and strategic private sale investors tokens are vested for 12 months with 15% token being unlocked on listing and rest with daily distribution from day 31 for the next 11 months. https://news.yahoo.com/nord-finance-raises-1-23m-104200710.html?soc_src=community&soc_trk=ma

Q5 from Telegram User @fabricino

The

first product available in your ecosystem will be

Nord.Savings

Explain what features will be available there and

why should I move my funds from other platforms where I use their

savings services to your savings platform?

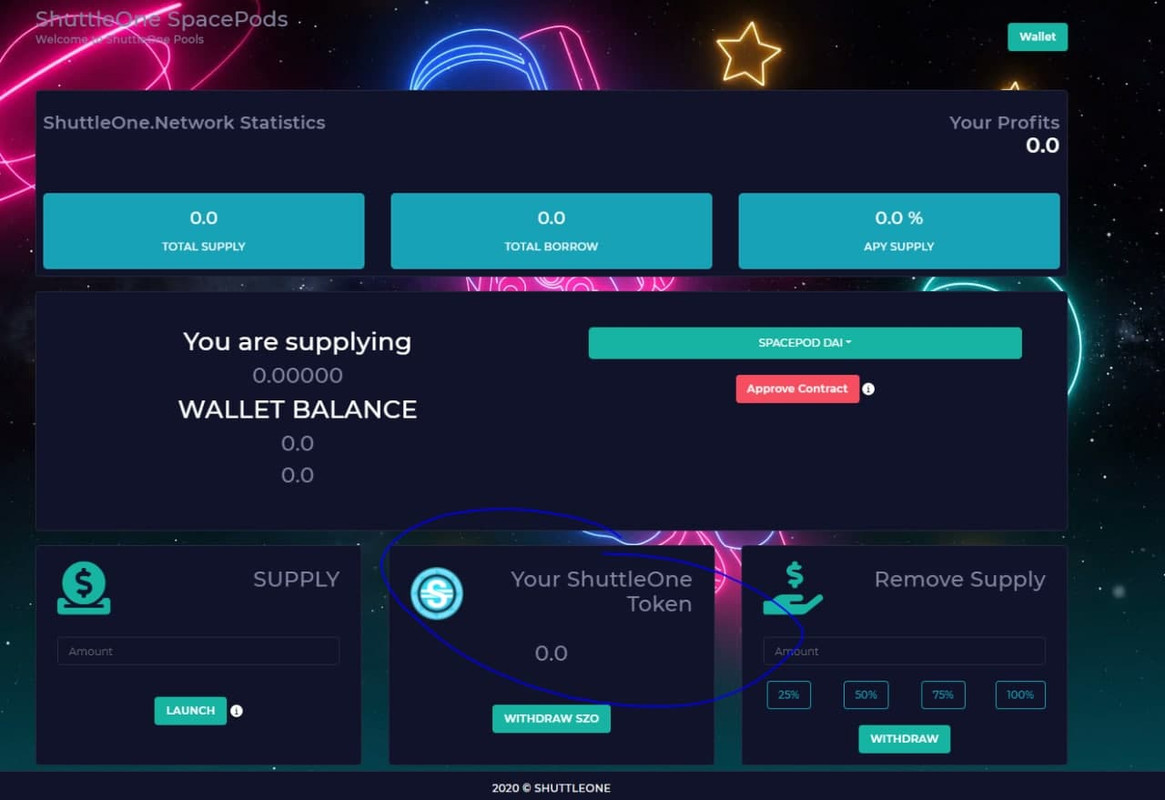

Amarnath | Nord Finance: Nord Savings allows optimizing returns through a multi-chain yield-farming mechanism for stable coin farming with the highest possible risk-adjusted returns. To maximize returns, the protocol employs the highest risk-adjusted APY’s. Whereas it leverages the DeFi Score framework to assess and analyze the dynamics of protocol risks. Nord.Savings provides a seamless interface to access the world of DeFi-based yield farming effortlessly without any technical implications as the traditional financial counterparts.

We are also not limited to single chain , as we are going to integrate with different blockchains enabling the user pools able to interact with most secure DeFi protocols and try to get optimize yield. We are also not limited to only one product as we are going to onboard additional services like advisory loans and swaps etc.. what we are trying to do is become an One stop solution for all the needs so that user dont need to switch between platforms incase of any change in priorities in future .

Q6 from Telegram User @bitalik_vuterin

Nord Advisory is interesting. It’s practically a robot which tells me how to invest according to my profile. Creates a custom strategy for me. As far as I know, this kind of things require a very performant AI. It’s very hard to do such a thing and it’s prone to errors. Who will take responsibility if that AI chooses to invest in a low quality token and I will loose my money?

Amarnath | Nord Finance: Nord’s robo-advisory service designed to bring customized strategies for users to hold better positions based on their financial goals. The automated robo service analyzes the user profile and evaluates personalized solutions that will help accomplish the users’ financial goals by employing a diversified portfolio.

Risk profile based on their risk required, risk tolerance and risk capacity to accomplish the user’s financial goals

By saying this I have to agree with you that the customized stratagies has to be back tested and make sure that user assets goes to safe and secure investments according to their risk appetite . As this involves lots of internal testings and we have chosen our road map to late 2021 so that we have enough time to test these stratagies and will have guarded launch of this services to make sure we learn over the time and implement changes if any accordingly .

Part 2 — live questions from the Telegram community

Q1 from Telegram user @Spott

Explain ZOKyo’s relationship with NORD FINANCE ?

Amarnath | Nord Finance: The Nord Finance team is always on a hunt to join forces that could bring out the best in the decentralized space. Today we undertake a crucial strategic partnership with Zokyo’s Blockchain Security team, a well respected and well renown team of white-hat hackers, cryptographers, security researchers, and blockchain engineers. Forging ahead, Nord Finance will have its entire product portfolio audited by Zokyo in a long term strategic security move. https://nordfinance.medium.com/nord-finance-forms-strategic-partnership-with-leading-blockchain-security-and-engineering-firm-ec03babe7c58

Q2 from Telegram user @vedamatrix

Do you create any tokenburn roadmaps for increasing the token value for customer benefits?

Amarnath | Nord Finance: We do have similar plans , as part of our token utility we have service fee structure in-place , brief details are as follows

Service fees: For the services rendered a small fee/profit share would be charged by the protocol in $NORD. These fees will be retained in the protocol treasury. As part of our revenue model we have some % of fund used to buy back our own token and move the same to the treasury. This will help us to believe in accumulating our own token and indirectly help to lock circulation supply from the market.

Q3 from Telegram user Marian Merheb

We can see your Founding Team on your page, but what about all your team right now? How many people do you have working with you? Are you looking to hire more staff? Could you tell us a little bit of their background and why did you choose them to work with you in Nord Finance?

Amarnath | Nord Finance: We do have 5 developers working under our CTO Jignesh , experience with blockchain , Solidity programming and Smart-contract writing and security is the main focus in choosing . We also have 1 CMO and under him marketing and PR team . We do have few advisors on board . We will revamp our website soon which will reflect with all details.

Q4 from Telegram user @AugusS7

An event as important as “Nord Finance IDO is on Polkastarter” why is it not on the Road Map or in the advertisements on your website? Is it because it was unexpected? If so, then should we not be guided by the information on your Road Map but by the official Telegram channel?

Amarnath | Nord Finance: Polkastarter is a permissionless DEX built for cross-chain token pools and auctions, enabling projects to raise capital on a decentralized and interoperable environment.

Our goal is to use a platform for enabling public to contribute in decentralized environment. So we have identified polka-starter in later stage of our IDO search and we are glad we chose them.

https://nordfinance.medium.com/nord-finance-nord-announces-its-ido-on-leading-cross-chain-auction-protocol-polkastarter-4f34bcfbf07d

Q5 from Telegram user Mega

Can you tell what is the use of NORD token in your platform? Do you have incentives program for holding NORD token?

Amarnath | Nord Finance: $NORD token has various utilities in the Nord Finance financial ecosystems:

Liquidity Mining: In order for the Nord Finance ecosystem to function properly, users would need to be incentivised to play the role of liquidity providers and stake their digital assets into the market making pools. As compensation for opportunity costs as well as impermanent losses, these liquidity providers which help to promote adoption of the Nord Finance ecosystem by staking or including assets to liquidity pools would be rewarded with $NORD tokens (i.e. liquidity “mining” programs on the Nord Finance ecosystem), according to each user’s relative contribution after various adjustment and correction parameters.

Incentivizing programs: Users can earn $NORD token incentives by participating in the platform, for example trading/exchanging, or development of new strategies for the vault.

Distributing Fee Rewards: In order to stimulate participation in the platform , $NORD token will be distributed as rewards to users for various contests and community giveaways.

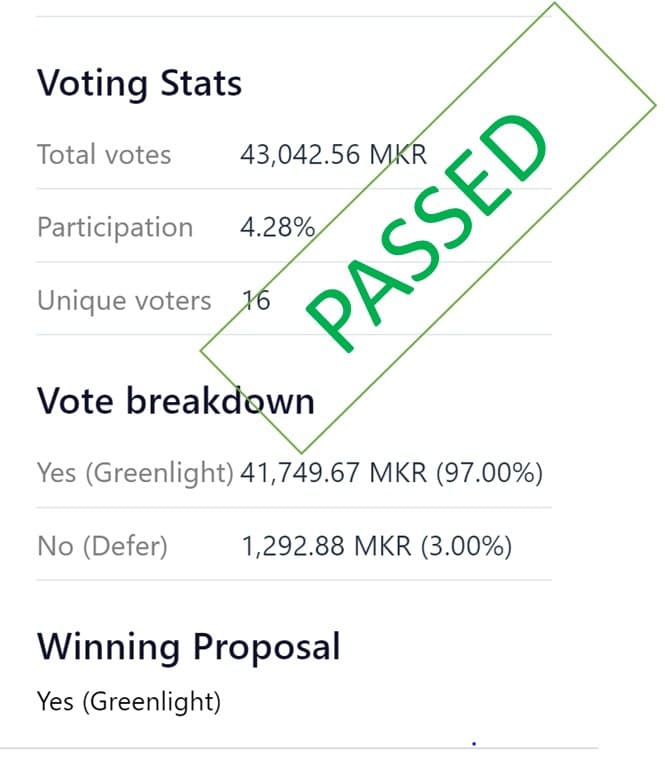

Community governance incentives: The $NORD token holders will earnestly participate in the protocol’s governance by voting on various proposals regarding product upgrades. Users will be required to stake their $NORD tokens in the staking program to participate in governance and vote on proposals, and as a reward they will be able to earn additional $NORD tokens proportionate to their contributions.

Service fees: For the services rendered a small fee/profit share would be charged by the protocol in $NORD. These fees will be retained in the protocol treasury.

Cross Chain Settlement: Using the $NORD token as the base platform currency, $NORD will expedite digital asset swaps between compatible blockchain seamlessly.

Q6 from Telegram user Borax

Which wallet applications on android or ios will you support to buy and sell Nord tokens to?

Amarnath | Nord Finance: We dont have any inhouse app for android or IOS , all users will have to interact directly on our website. However we have partnered with Frontier which has their inbuilt app to interact with nord finance products in future .

Q7 from Telegram user @konditer_rolex

How can I Purchase Nord Token without using the Ethereum network?

Amarnath | Nord Finance: You cant as of now ,we are ERC20 token and will be available to trade on uniswap on 12th Jan onwards. We do have plans to launch our token on other blockchains , however it will come in later stage after integrating our protocol into other chains.

Q8 from Telegram user @Korryl

Hello, you have great project.Do you have any private sale or ICO that still ongoing right now ? How to participate ? Could you pls share link where to buy?

Amarnath | Nord Finance: We have our IDO on polkastarter on 12th Jan and immediately listing on Uniswap same day with $373K initial market cap with very low initial supply of 4.14%.

Our whitelisting application process is completed with overwhelming 20K+ applications for 700 slots . We will have lottery results on 12th Jan before the IDO.

https://nordfinance.medium.com/nord-finance-nord-announces-its-ido-on-leading-cross-chain-auction-protocol-polkastarter-4f34bcfbf07d

Q9 from Telegram user @smelekin

Did you publish your smart contract to be viewed by public or is it private?

Amarnath | Nord Finance: Our Smart contract for both Token contract and Nord savings V1 is under security audit , we will release them for the public after completing the audit with detailed report !

Q10 from Telegram user @m_i_l_e_s_u

What was the biggest milestone your project has? What is plan in the future ?

Amarnath | Nord Finance: Nord Savings V1 on ethereum is planned to be launched in Jan 2021, followed by our liquidity mining program and applying stable coin yield farming strategies. Savings V2 is planned in Q1 2021 which will be extended to other blockchains such as the binance chain , matic , tezos and polka dot ( not in any particular order). Then we have a road map to launch swaps, loans and advisory etc.. . More can be found at https://nordfinance.io/

Part 3 – Quiz Results

In the final part we tested your knowledge in terms of NORD Finance. They’ve prepared 4 questions for this part. The total reward pool for quiz was 700$.

For more information and future AMAs, join our Social Media channels:

English Telegram group: https://t.me/Satoshi_club

Russian Telegram group: https://t.me/satoshi_club_ru

Spanish Telegram group: https://t.me/satoshi_club_spanish

Telegram Channel: https://t.me/satoshi_club_channel

Twitter: https://twitter.com/realsatoshiclub

Website: https://esatoshi.club/

Our partners:

NORD FinanceCommunity: https://t.me/NordFinance