PART 1. Introduction of Telos project and community questions.

Hello, Satoshi clubbers and guests of this site. We are happy to present you with a Telos crypto project.

Telos powering the networked ecosystem of the future.

The Telos Network working with visionary leaders and communities to build a new trusted global economy

Features of Telos Network:

- 0.5 second block times

- Free user transactions

- Free user accounts with human-friendly names

- 10,000+ TPS

- Massive community network effects

The plan of AMA session:

- Part – Introduction and preselected questions.

- Part – Live questions

- The Quiz about Telos

The reward pool is 500$

Leading the AMA our clever and fun admins:

Mary | Satoshi Club – @madamlobster and Gold Rocket | Satoshi Club – @GoldRocket27

The Representative of the project:

Suvi Rinkinen – Representer the Telos Foundation that is the promotional and marketing body for the decentralized Telos blockchain network.

Douglas Horn – GoodBlock, dStor – DApp developer. Telos architect. Wrote the white paper and initially pulled the community and devs together.

Telos doesn’t have a “founder” per se. We are really decentralized.

That also means there’s no Charlie Lee who can dump 40% of the supply if they choose.

Introduction of Telos project.

Gold Rocket | Satoshi Club:

We hope to learn a lot!😊

Mary | Satoshi Club:

Hello Satoshi Club! We are happy to announce our AMA session with Telos! Welcome to Satoshi Club😀

Gold Rocket | Satoshi Club:

Good evening, dear community!

We are delighted to welcome our guests from Telos.

Suvi 🇫🇮:

Hello everyone!

Gold Rocket | Satoshi Club:

Greetings @suvirink & @DAPPerD! Welcome to Satoshi Club!

Mary | Satoshi Club:

Welcome here 😀

Suvi 🇫🇮:

Thank you, happy to be here to tell you about Telos 😁

Gold Rocket | Satoshi Club:

Thanks ❤️for joining.

Douglas Horn – GoodBlock, dStor:

Hi!

Mary | Satoshi Club:

That’s great🚀 Welcome 😀

Douglas Horn – GoodBlock, dStor:

Excited to talk about Telos.

Suvi 🇫🇮:

Me too

Mary | Satoshi Club:

Ready to start, guys?😀

Suvi 🇫🇮:

Yes 😁😁

Gold Rocket | Satoshi Club:

Welcome.

Mary | Satoshi Club:

Could you please introduce yourself and tell us more about Telos?🎉

Gold Rocket | Satoshi Club:

Tell us please a bit about yourself before we hear about Telos

Mary | Satoshi Club:

Me first 😂

Gold Rocket | Satoshi Club:

As always 🚀😁

Douglas Horn – GoodBlock, dStor:

Just took a look at this chart. It made me happy!

Mary | Satoshi Club:

Wow,🚀🚀🚀 the moon is almost here. Mars next🚀

Gold Rocket | Satoshi Club:

It’s amazing🚀🚀🚀

Mary | Satoshi Club:

It made happy all Telos holders😉

Douglas Horn – GoodBlock, dStor:

Here’s the weekly version.

Mary | Satoshi Club:

Stable growth 💪 It’s really cool 😎

Douglas Horn – GoodBlock, dStor:

Yeah, we’ve worked hard and people love our new Uniswap Liquidity plan.

Plus we just released an ambitious 2021 Tech Roadmap that people loooooove.

Gold Rocket | Satoshi Club:

The results are visible!👍

Mary | Satoshi Club:

I heard about it😀 Can you share this plan with our community?

Suvi 🇫🇮:

Here is the full plan https://telos.net/telos-uniswap-liquidity-implementation-plan-tulip/

Douglas Horn – GoodBlock, dStor:

Big picture it’s fixing our liquidity problem that has kept price 3,000x below comparable chains by:

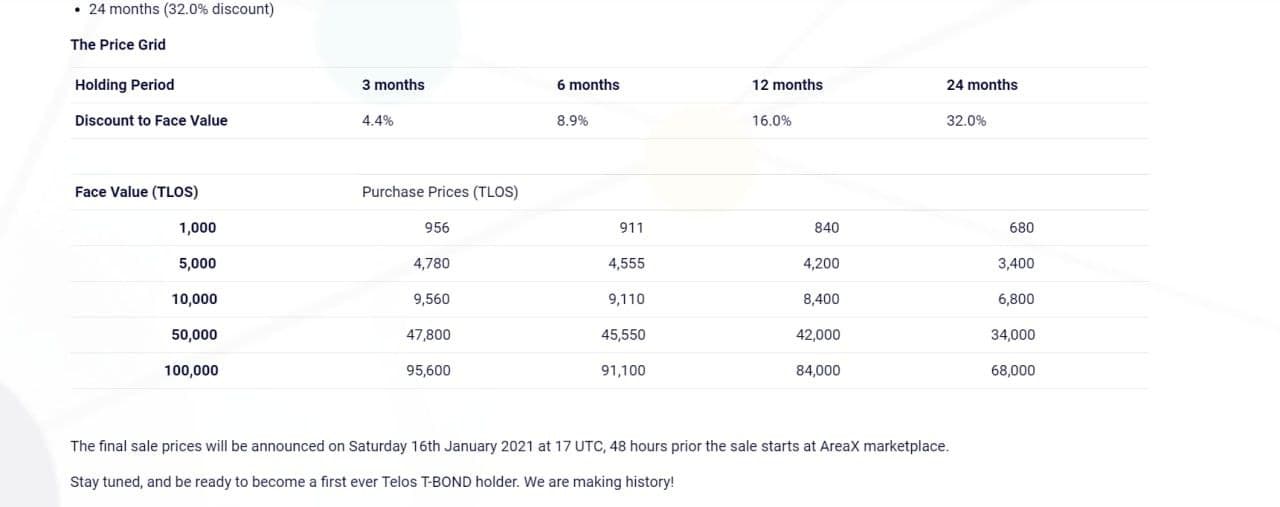

🔥 Sell T-Bonds to finance ERC-20 TLOS presale.

🔥 Conduct limited presale with ascending prices each round.

🔥 Put big liquidity pools on Uniswap & TSwaps.

🔥 Add top exchange listings.

Mary | Satoshi Club:

Amazing plan! Telos is on fire 🔥

Douglas Horn – GoodBlock, dStor:

Here’s a shorter version.

https://telos.net/tulip-plan-eli5-explain-it-like-im-5answer-platform-peeranha-io-is-giving-out-generous-tlos-rewards-for-a-limited-time/

Mary | Satoshi Club:

We will definitely read it!🔥

Suvi 🇫🇮:

I am Suvi Rinkinen and I represent the Telos Foundation that is the promotional and marketing body for the decentralized Telos blockchain network. Unlike other foundations, the TF does not have any ownership of the network. We work for the network in terms of business development, partnerships, and marketing. Telos has hundreds of contributors around the world, we are safe and proud to say we are truly decentralized and every token holder has a governance vote.

Douglas Horn – GoodBlock, dStor:

Yeah.

Gold Rocket | Satoshi Club:

This is a very interesting solution!

Mary | Satoshi Club:

Nice intro, thank you, Suvi😀 I see you like decentralization as well😉

Suvi 🇫🇮:

Most of all decentralization is a community protection form. There is no single entity any regulators could point at telos who has been behind the success. This is not the case with most of the chains that have companies running the whole network (people rely on one entity providing value).

Secondly, only open networks where everyone has a genuine opportunity to participate can scale at mass. Telos is open and not a private club.

And this is already proven to work. We have +200 contributors, individuals, apps, node operators, community activists. We all are in the same game to make telos succeed.

Gold Rocket | Satoshi Club:

To be honest, this is captivating! Your openness!

Suvi 🇫🇮:

Yes. We have a functional WORKER PROPOSAL Telos works system where anyone can put their proposal and get compensated for the value they produce. We have seed-funded various apps, one of them got later 1 mil EUR funding from the EU.

Douglas Horn – GoodBlock, dStor:

I’m Douglas Horn. I wrote the white paper and initially pulled the community and devs together, but Telos doesn’t have a “founder” per se. We are really decentralized.

That also means there’s no Charlie Lee who can dump 40% of the supply if they choose

Mary | Satoshi Club:

We had Charlie here recently 😀 he said he didn’t.

Gold Rocket | Satoshi Club:

😁😅

Mary | Satoshi Club:

But I understand what you’re talking about and you really choose the decentralized way of development.

Douglas Horn – GoodBlock, dStor:

Okay. I like Charlie actually. I just thought it was a well-known example. I Shoulda said Brad Garlinghouse I guess. 😆

Mary | Satoshi Club:

😂 it’s ok

Gold Rocket | Satoshi Club:

Thanks, guys for the great intro!😁

Suvi 🇫🇮:

Douglas and I talk a lot…😂😂

Gold Rocket | Satoshi Club:

We love Charlie too! And I am sure we will love you too! ❤️

Gold Rocket | Satoshi Club:

Ready to jump into community questions?😊🚀

Douglas Horn – GoodBlock, dStor:

You got it!

Suvi 🇫🇮:

Yes 😊

Douglas Horn – GoodBlock, dStor:

Psyched for great Qs!

Preselected questions about the Telos project.

Gold Rocket | Satoshi Club:

Q1 from Telegram user @ovkneze_big

Telos positions itself as a sustainable decentralized EOSIO network. Why did you choose EOS? Do you solve the problems of this platform alone or the problems of the crypto environment in general? What problems do you consider the most relevant today and have already been solved by Telos?

Douglas Horn – GoodBlock, dStor:

Yes.

I was part of the EOS mainnet launch group actually. I was concerned about some issues I saw that were going to become problems. No one in power wanted to hear about them at the time.

4 weeks after launch it became clear that not only were these EOS problems real, but they were worse than I feared. So I wrote the Telos whitepaper and started getting others who felt the same to join me.

We solved all the big EOS problems with our design & hard work.

Suvi 🇫🇮:

Eosio is one of the leading smart contract platforms. It solves many issues that for example Ethereum has. There are some applications that are just impossible to be run on Ethereum, like those that require microtransactions. We have plenty of social media applications, who would be making significant losses if every transaction would cost several USD to process.

But we do not position telos as a “killer chain” of anything. Our core values are openness and collaboration and this is why we are now heading towards Ethereum and the larger crypto community; there is room for many legit operators.

Mary | Satoshi Club:

Yes, glad to see that you’re not planning to kill any blockchain. In my mind, it’s better to cooperate if it’s possible or to offer their own ways of development.

Gold Rocket | Satoshi Club:

This is a good tactic in crypto.

You have great intuition by the way😉

Mary | Satoshi Club:

Yes, I heard that EOS is far from perfect and I see that wasn’t just rumors

Douglas Horn – GoodBlock, dStor:

We solved a lot of EOS-specific problems but also problems of crypto in general like:

Super high capacity

1/2 second block times

No front running

True community governance

Extending our L1 gov engine to all Dapps

Free TXS.

Mary | Satoshi Club:

I remember, that most everyone was talking about problems with governance. Happy to hear that you find a solution👍 Oh, that’s a very important point💪

Gold Rocket | Satoshi Club:

How big is your community?

Douglas Horn – GoodBlock, dStor:

There are over 500,000 unique accounts on Telos and growing very quickly. We are often adding more accounts per day/week/month than EOS in fact.

Suvi 🇫🇮:

We have over 500 k user accounts and growing. We have a unique tactic at telos. First, produce value, then start distributing the tokens more widely.

Telos is an ideal position for growth, already proven track record. 😊😁 not WP stuff.

Douglas Horn – GoodBlock, dStor:

Yep. That’s how most big tech unicorns grow.

Gold Rocket | Satoshi Club:

This is an incredible amount! 👏👏👏

Suvi 🇫🇮:

Also, let’s keep in mind. TELOS is running on EOSIO, not EOS. EOS is only one implementation of EOSIO software. They may be the first, but not the best 🤓🤓🤓

Telos active community has worked for over two years to improve EOSIO 😊

Douglas Horn – GoodBlock, dStor:

Yes, we believe there will be massive blockchain adoption and Telos will be a big part of it as

Free & instant transaction for more expensive chains, but on a real governed blockchain, not just a roll-up.

Fee-less DeFi.

Adding free voting to be used by other chains through CCI

Gold Rocket | Satoshi Club:

You want to make an ETH token. TELOS ERC-20, in order to raise money for its listing and create liquidity, you launched the sale of T-BONDS, which are Maribel-NFTs, which are secured with funds for a certain period. The higher the blocking period, the higher the discount percentage forT-BONDS. I understand correctly?

Suvi 🇫🇮:

Mary | Satoshi Club:

Now we know your reasons and they seem logical and clear! Sure, we will add members to your community today💪

Douglas Horn – GoodBlock, dStor:

I think the “Ethereum killer” phrase is the stupidest thing I’ve ever heard in blockchain

And I’ve heard a lot of stupid stuff.🤣

Suvi 🇫🇮:

Me too 😂😂

Mary | Satoshi Club:

Lol, my thoughts 😂

I see the word NFT😂🔥

Gold Rocket | Satoshi Club:

Yes😁

Douglas Horn – GoodBlock, dStor:

Yep! Plus T-Bond NFTs are a new way that other projects will also raise funds or liquidity. We have a long line of projects coming to use these on Telos. It could become the next ICO-type boom.

Mary | Satoshi Club:

Hope not only “could” but that it “would”😀

Douglas Horn – GoodBlock, dStor:

Yeah. T-Bond NFTs are the nexus of DeFi & NFTs. 🚀🚀🚀

Gold Rocket | Satoshi Club:

Thanks a lot for the clarification! I’m starting to love your project😁❤️

Douglas Horn – GoodBlock, dStor:

We get a lot of good press coverage.

Suvi 🇫🇮:

Yes, T bonds are the first step in the larger TULIP plan. There is only a limited number of tokens to be purchased at these low prices.

We can think the T-bond sale as a private round for the earliest who want in.

T-bonds are NFTs that include a number of tokens that can be resold immediately without them going into exchanges though.

Why we release T BONDS with relatively low value is to grow our community, get more people in as stakeholders. No one during these two years has been able to buy a big amount of TLOS without pumping the price significantly, as no one has really wanted to sell.

Gold Rocket | Satoshi Club:

Show these NFTs, please🙏

Suvi 🇫🇮:

SOON TM 😄😄

Gold Rocket | Satoshi Club:

Ready for the next question?😁🚀

Suvi 🇫🇮:

Yes

Gold Rocket | Satoshi Club:

Q2 from Telegram user @Egory0k

In your WP you offer economic decentralization – no whale addresses. How will Telos achieve this? Is it really worth removing big investors from the game?

Douglas Horn – GoodBlock, dStor:

One thing that separates Telos from other projects is, they are promising to do something groundbreaking in 2 years…

Telos has already been doing groundbreaking stuff FOR 2 years!

But because of liquidity, the price got stuck. Now we’re gonna take the cork out of the champagne bottle!🍾

Gold Rocket | Satoshi Club:

Let’s do it finally! 🚀🥂🍾

Mary | Satoshi Club:

No more problems with liquidity 🎉 congrats!

Douglas Horn – GoodBlock, dStor:

Well, once the TULIP 🌷 plan is complete. But yeah, it’s getting better now but barely even starting.

Mary | Satoshi Club:

@HelloTelos To List On @UniswapProtocol Following Liquidity Implementation Plan

Read More: https://t.co/bzWGjBVPa6

— Digital Notice (@digital_notice) January 14, 2021

Mary | Satoshi Club:

I like these flowers 😄

Suvi 🇫🇮:

Right, this was the initial distribution over two years ago to ensure a fair launch, and it has helped Telos to position itself in the market as a decentralized and governed blockchain. We have never restricted anyone from buying as much TLOS as they want, but like mentioned, it has been a challenge as people value their TLOS much more than the current market price.

But in order to get more stakeholders in, we have T Bonds and also Uniswap Sale right after. We welcome big and small buyers alike. 😊🔥

Douglas Horn – GoodBlock, dStor:

We did this over 2 years ago!

What we did was:

1) Cap <1% of the accounts on the EOS genesis snapshot to 40k TLOS. This alone reduced the token supply by 2/3rds!

2) Keep just a 5.2% founders reward that was spread among about 130 contributors worldwide.

Most chains don’t become centralized with whales. They start out that way. As time passes, chains get less and less centralized economically, in general.

Mary | Satoshi Club:

Can you tell that now Telos is 100% decentralized?

Mary | Satoshi Club:

Fair distribution is the key👍

Douglas Horn – GoodBlock, dStor:

Well, StakingRewards.com uses % of circulating supply staked as one of their quantifiable measures of decentralization. Telos is in the top 3 in this measure.

I doubt that anyone person owns more than 3% of the TLOS token supply. I don’t think you could say that about many chains.

Suvi 🇫🇮:

There is no single entity behind or Telos is not controlled by a few whale accounts, this is a clear strength for the network 🧐

Mary | Satoshi Club:

Ok! I see, that you really achieved what you planned!

Suvi 🇫🇮:

With tightening regulations, ( I don’t want to spread FUD) many projects need to look at again their governance and who is actually running the projects.

Mary | Satoshi Club:

I don’t know if it really works somewhere.

Douglas Horn – GoodBlock, dStor:

So true. We solved that from the beginning. No company, no ICO, no sketchy practices…greater regulation will probably only help Telos by removing some very bad actors in the crypto world.

Suvi 🇫🇮:

Are we the only one 😅😅

“Telos style”

Mary | Satoshi Club:

We have a lot of these actors here! And you have your own style.

Suvi 🇫🇮:

It is clearly a risk factor for any investor as well.

Douglas Horn – GoodBlock, dStor:

Bur, we’re also decentralized because no one company owns or leads Telos. It’s run by over 50 validator companies around the world that compete for position while cooperating to build Telos.

Suvi & I work for competing validators in fact!

Mary | Satoshi Club:

And now you will harvest results 😄

Gold Rocket | Satoshi Club:

How interesting! The one who invented this is a genius! 😁

Suvi 🇫🇮:

How refreshing in crypto 😅😅

Mary | Satoshi Club:

Thank you, guys, for your answers!

Suvi 🇫🇮:

First, build then start selling any tokens 😅

Douglas Horn – GoodBlock, dStor:

Yeah, 2.5 years after the project began! 2 years after the mainnet launch in December 2018.

This is the opposite of almost every other crypto around but bitcoin.

Suvi 🇫🇮:

Satoshi style.

Mary | Satoshi Club:

Huge work was done👍

Suvi 🇫🇮:

Hard work, hahaha. Well, I am proud of all those who have worked to do this.

Douglas Horn – GoodBlock, dStor:

We built everything people got so excited about in the EOS whitepaper but that Block One never built. Plus now a LOT more.

We gotta talk about the new Roadmap at some point because it’s incredibly exciting.

Gold Rocket | Satoshi Club:

Yes, time makes its own adjustments! And flexibility in the crypto world is half the battle!😉

Mary | Satoshi Club:

We have one question later😉 you will definitely have this chance

Mary | Satoshi Club:

👍 Ready to proceed?😄

Douglas Horn – GoodBlock, dStor:

Yep

Gold Rocket | Satoshi Club:

Q3 from Telegram user @lzamg

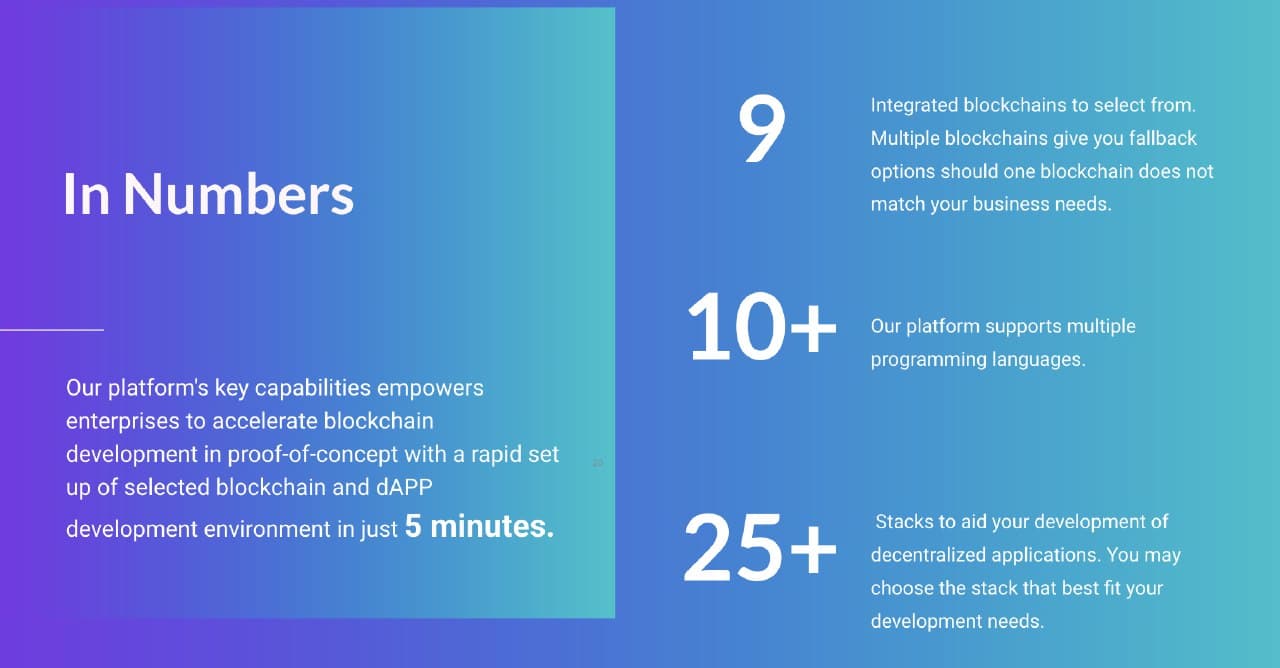

I understand that Telos provides the possibility for developers to create their tools and DApps. So if I want to launch my DApp on Telos, what is the step by step I need to follow to do so? Do you also offer financial support in certain conditions?

Suvi 🇫🇮:

We do have a worker proposal system, where anyone can submit their proposal and community votes if the project should get funding. Many projects have been built with help of this.

In addition, Telos Foundation offers small grants, there are angel investors on telos.

Let’s get telos to the market cap it deserves (how much 🧐🧐🧐 given we have delivered all that block one promised and more and EOS failed to deliver) so we have more funding for projects 😊

Douglas Horn – GoodBlock, dStor:

We have helped dozens of apps with some form of financial assistance and also technical assistance. We give grants, devs can use the user-voted Telos Works funds and we have a very helpful developer community including help from the Telos Core Devs. Dapp developers love us. Several have said we saved them over a year of development!

Suvi 🇫🇮:

Yes, we are really happy to get more people into the ecosystem, there is certainly room for growth.

Gold Rocket | Satoshi Club:

Visionary charity 😊

Douglas Horn – GoodBlock, dStor:

Not charity. Wise investments in the growth & utility of the Telos blockchain!

Mary | Satoshi Club:

Wise words 😃

Do you have a step-by-step guide?😄

Douglas Horn – GoodBlock, dStor:

To create an app, get on the telos TGM groups like @hellotelos, @telosdappdevelopers, etc. You can also go to telos.net or direct to docs.telos.net to get a ton of information and sample code.

Mary | Satoshi Club:

Oh, that’s easy 😄

Do you have statistics on how much funds were granted in total?)

Suvi 🇫🇮:

All we do is weighed against the goal of network growth.

Douglas Horn – GoodBlock, dStor:

Not on hand. But a few hundred thousand just in Telos Works proposals.

Mary | Satoshi Club:

Wow! Great! 👏

Gold Rocket | Satoshi Club:

Very good detailed answer !!! Thank you so much!😊👍

Douglas Horn – GoodBlock, dStor:

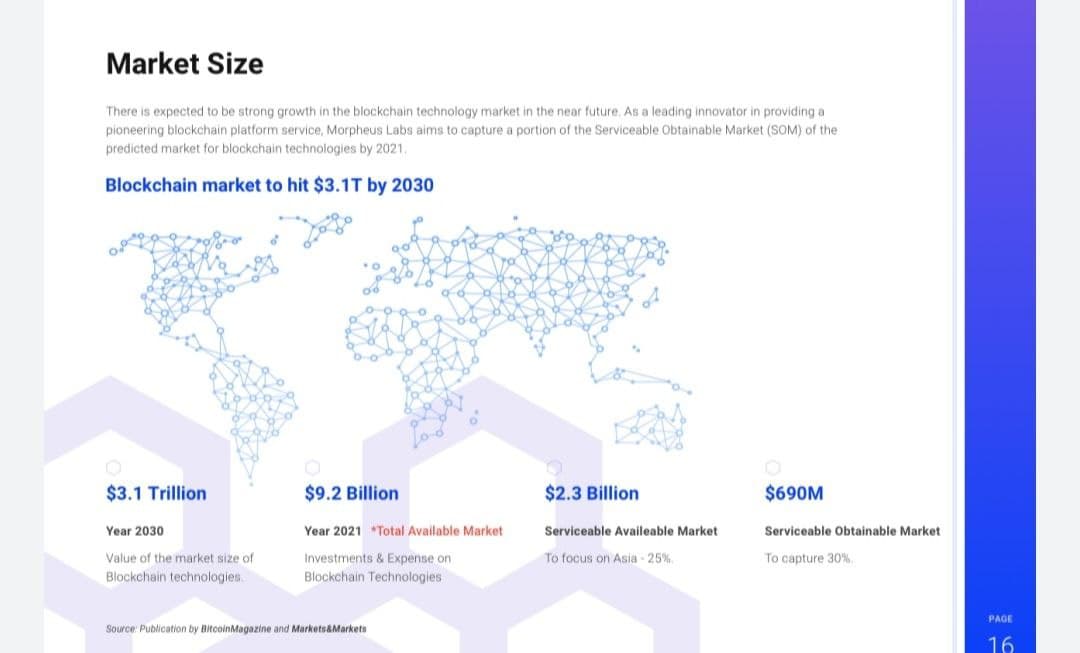

When you look at chains like Tezos or Cardano with massive valuations and almost no Dapps, it’s hard not to think that Telos should have at least the same market cap with over 100 Dapps (see explore.telos.net.

I’m not saying those should be lower, I just think Telos should be up there at similar m.c. of course that would be around a 3,000x in price.

Mary | Satoshi Club:

Yes, it’s definitely true.

Ready for the next question?😃

Douglas Horn – GoodBlock, dStor:

Yes Please.

Gold Rocket | Satoshi Club:

Q4 from Telegram user @Gutike95

You mention that by 2021 you will develop many more applications that use TLOS as a payment method, but could you really give us a little more detail about how those applications will be? one will be of NFT art but what about the rest?

Douglas Horn – GoodBlock, dStor:

We have so many already. For payments, there’s Sesacash, for example, which is a West African payment platform that used to be Yensesa on Ethereum but came to Telos for the free TXS and high capacity. We actually have a lot of payment Dapps coming now.

But Telos has much more function than just payments. It’s the most powerful platform for DeFi, for example. Telos is about the only place that you can bring on wrapped bitcoin and instantly (0.5 seconds) make payments of as little as 1 Satoshi because there’s no fee! With wrapped Eth coming too, and an Ethereum bridge for ERC-20 tokens, that means you don’t have to be a millionaire with huge transactions to be profitable with DeFi because of the huge Ethereum gas fees.

So Telos will definitely be the DeFi platform of the developing nations soon.

We have NFT markets now and they’re heating up.

There are so many Dapps too. See explore.telos.net for more.

Mary | Satoshi Club:

When wrapped ETH will be available?😃

Douglas Horn – GoodBlock, dStor:

We just released a new 2021 Tech Roadmap which is pretty incredible.

https://telos.net/telos-technical-roadmap-2021/

Mary | Satoshi Club:

NFT markets? You mean you have these Dapps on the Telos chain?

Douglas Horn – GoodBlock, dStor:

Of course! Several. My favorite is areaxnft.com

Suvi 🇫🇮:

Yes, Areas is one of the NFT markets we have.

Mary | Satoshi Club:

Super 👍 it’s cool

Mary | Satoshi Club:

Even Telos ID👍😄

Your roadmap looks very solid 👏

Douglas Horn – GoodBlock, dStor:

And we will achieve these. About 1/3rd of them will release in Q1!

Mary | Satoshi Club:

Don’t forget to share your achievements with Satoshi Club 😉

Douglas Horn – GoodBlock, dStor:

Totally!

Gold Rocket | Satoshi Club:

By the way, I read something in your roadmap and I have a question.

You are running the Ethereum virtual machine in 2021. Will it be a parallel network with ether or will it work as a 2 layer?

Douglas Horn – GoodBlock, dStor:

It’s a parallel network but faster and about 1% the gas cost of Ethereum.

We are not looking to replace Ethereum but there are many Dapps now that just can’t handle the rising gas fees. Some of those can come to Telos EVM to save money while reducing congestion on the Ethereum mainnet.

Suvi 🇫🇮:

100% We really embrace cross-chain collaboration over any tribalist’s fights. It is best to be objective and find synergies for common good for the crypto community.

Douglas Horn – GoodBlock, dStor:

Cross-chain interaction (CCI) is also on our 2021 roadmap. You will be able to perform smart contract actions on other connected chains through CCI from Telos!

Mary | Satoshi Club:

When I hear the word gas fees my eye start to tremble😂 they are insane in the bad meaning of this word.

Douglas Horn – GoodBlock, dStor:

Some new things we’ll release:

✅ dStor decentralized storage

✅ Telos EVM – run Ethereum solidity dapps for almost free on Telos

✅ Telos Private – zk proofs based privacy sidechain

✅ Telos ID

✅ Telos Location – blockchain provable location

✅ Decide Voter mobile app for making Telos Decide voting & governance super easy!

Suvi 🇫🇮:

I mentioned earlier that it is difficult for some apps to run with high gas fees.

Crypto is not only about generating massive wealth, but this technology actually can be life-changing for many (more freedom, more places, and opportunities for people to make their living) one example can be an artist or a photographer who has so far suffered from centralized marketplaces that actually eat their profits. I think shutter stock pays like 10 cents per download for the photographer. Now imagine this on-chain where there are high transaction fees. It becomes very difficult for all participants.

Mary | Satoshi Club:

I should check it😂 but after AMA, because I can disappear there and spend all my money 😂

Douglas Horn – GoodBlock, dStor:

I hear you there! I love our NFT artists on Telos!

Suvi 🇫🇮:

Happy to check in here every day 😬😬😬

Gold Rocket | Satoshi Club:

And we are very glad to have you here today❤️

Mary | Satoshi Club:

Satoshiclubbers, don’t forget to join here to stay updated 😄🚀 @HelloTelos

Mary | Satoshi Club:

Sure, you will get a lot of Dapps which will come to work on Telos🚀

Thank you for your answers 👍 Ready to proceed? Or you want to add something?😄

Suvi 🇫🇮:

Douglas probably adds 😅

Douglas Horn – GoodBlock, dStor:

Thank you so much for the great questions!

If anyone wants to come to the @hellotelos group and create a free new Telos account, we will tip you some free TLOS to start you off so you can explore why we are so excited about our awesome Dapps and super positive & helpful community.

Gold Rocket | Satoshi Club:

By the way, I already made an account today 😉

Mary | Satoshi Club:

You’re real rocket😂

Suvi 🇫🇮:

She is just not interested in being late to the party

Gold Rocket | Satoshi Club:

I plan to use and study this further 😊

Gold Rocket | Satoshi Club:

No martini no party 😂

Suvi 🇫🇮:

😅😂😂😂Maybe someone sends you Martini NFTS. I have only cats coming.

Gold Rocket | Satoshi Club:

I will be happy. If this happened! I really like NFT😁

Suvi 🇫🇮:

I think I have whisky or something.

Maybe Finnish Koskenkorva vodka would be $LEGENDARY

Gold Rocket | Satoshi Club:

So! Can we proceed to the next question? 😊

Suvi 🇫🇮:

Yes, please.

Douglas Horn – GoodBlock, dStor:

I’m pretty psyched that people had 2 years to get into Telos very cheap. It really helps with decentralization and allows people in the developing world to better take part. But now that’s going to change in a big way through the TULIP 🌷 plan and it is going to change a lot of investors’ lives.

Suvi 🇫🇮:

Well, the opportunity is still over there. Maybe not in 2 months 😬😬😬

Douglas Horn – GoodBlock, dStor:

Yeah. This is the sweet spot. But it’s picking up a lot of steam now.

Suvi 🇫🇮:

I am most of all psyched that with TULIP plan we open the opportunity for people to get into our winning club. No empty promises, we delivered already, and continue to deliver.

Gold Rocket | Satoshi Club:

Good job!👏👏👏

Suvi 🇫🇮:

You can’t have a better track record than Telos has

Mary | Satoshi Club:

Yes, TULIP is a chance 👍

Suvi 🇫🇮:

👍👍🔥🔥🔥👍👍

Gold Rocket | Satoshi Club:

I’m sorry I didn’t know about you 2 years ago😊

Douglas Horn – GoodBlock, dStor:

Well, that’s good because it’s actually cheaper now!

Gold Rocket | Satoshi Club:

Q5 from Telegram user @JesusFre1tes

Reading about TELOS, I found that dStor is a decentralized cloud storage platform like Filecoin or Siacoin in some aspects and like Amazon Web Services or Google Cloud in others. My question is, can storage node operators earn TLOS as “miners” for dStor? How will it be possible to do this to incentivize high-performance nodes with a higher payout?

Douglas Horn – GoodBlock, dStor:

Yeah, I’m really proud of dStor and what it will do for all blockchain. All kinds of chains need this. It’s not just for Telos. But the storage node operators will all be paid on Telos in TLOS tokens.

One thing no cloud storage project like Filecoin is doing is invoicing services in fiat with credit cards. So 99.5% of companies can never use them. dStor does bill this way and offers around 35% lower costs than AWS or Google Cloud. So we will also capture a lot of non-crypto businesses just looking to save.

Half of this income gets pulled into the Telos economy to pay storage node operators. Cloud storage alone is a $170B year business. Imagine if dStor captures even 3% of that!

Check out dStor.cloud for more info.

Mary | Satoshi Club:

Credit cards are great! Do they accept credit cards from all over the world?

Douglas Horn – GoodBlock, dStor:

Yes. You pay at the end of the month in credit cards or regular bank transfers. (You can also pay in TLOS. )

To most payment processors there’s no crypto element at all. So banks can handle it fine.

On the back end, paying the massive global network of storage node operators, we use the efficiency and instant payments of Telos to streamline things.

Just think how much new fiat wealth will onboard to Telos and crypto, in general, each month!

Mary | Satoshi Club:

Perfect 👍

Gold Rocket | Satoshi Club:

The future is born before our eyes! It is surprising! 😊

Douglas Horn – GoodBlock, dStor:

We are even considering offering a dStor governance & revenue sharing token so we can fully decentralize it as well. But that would be after Telos if it happens.

Suvi 🇫🇮:

There is also an increasing demand to find decentralized service providers. It seems that there are too many operators that actually are “single point of failure”

$BULLISH for security

Gold Rocket | Satoshi Club:

Sounds good 👍😊

Mary | Satoshi Club:

Yes, it’s an interesting idea😄

Gold Rocket | Satoshi Club:

Thanks for the answer! ready for the last question of this part?😉

Suvi 🇫🇮:

Yes 😊😊😊

Gold Rocket | Satoshi Club:

Q6 from Telegram user @meml97

I saw that you are planning to add Telos Private in Q3 2021, why did you wait so long to now add this privacy feature? Will this Telos Private be any kind of premium or maybe some sort of membership feature, or will it be available for everyone?

Douglas Horn – GoodBlock, dStor:

Well, no 3rd generation smart contract platform in the world offers private TXS yet, so it’s not like we are “waiting’. 😆

It’s great to have the main chain that’s transparent. And we see a lot of govt crackdowns forcing privacy blockchains to be delighted etc. So we did not want to create that situation for Telos.

Telos Private will be a separate chain that you can send any Telos-based tokens (including wrapped BTC or ERC-20 tokens).

Once there, you can make payments, do DeFi, etc. But then when they come back to Telos, they are transparent again.

There will be small fees for using Telos Private (also with Telos Location, Telos EVM, etc) these will be very low but the plan is to have them generate enough income for the gain to keep funding everything without having to do any inflation (Telos has been zero inflation for 1.5 years now!!!) while still allowing basic TXS to be fee-less.

Mary | Satoshi Club:

Nice move, it is really important for those, who need privacy

Douglas Horn – GoodBlock, dStor:

I expect that people will use it in various ways. For a company that just wants to keep its vendors as a trade secret, I doubt any other steps would be required. For a political dissident trying to bring democracy to a dictatorship, they may want to add more steps since lives are in the balance.

Mary | Satoshi Club:

It’s like a must-have feature now. To be honest, even I interested in this😄 just because I want more privacy 😉

Douglas Horn – GoodBlock, dStor:

People should have a right to privacy. The Govts like to paint it as crime & tax evasion, but really, it’s just some personal privacy 99% of the time.

Real criminals won’t use Telos Private, they will use $100 bills as they do now or occasionally Monero.

Mary | Satoshi Club:

Yes😂 actually, they always find a way.

Douglas Horn – GoodBlock, dStor:

Imagine if Apple’s vendor payments were all transparent and people could divine a lot of potential secrets based on who the vendors are, who they aren’t & how much they’re being paid, and when. That data is valuable not only to competitors but people betting on Apple stock, the stocks of various suppliers, etc. There’s a lot riding on these things and very legitimate reasons to use strong privacy tools.

Mary | Satoshi Club:

It’s not using just by criminals like some are saying.

Sure, that’s right! And thank you for care about our privacy 👍🚀

Suvi 🇫🇮:

Yes, this is funny… I mean then the whole “real world” would-be criminals 😅😅

Mary | Satoshi Club:

Yes😂

Gold Rocket | Satoshi Club:

Great answer! Do you want to add something to our community before the open chat? Useful links for example?

Douglas Horn – GoodBlock, dStor:

telos.net

explore.telos.net

Blocktivity.info where Telos is on top .

Suvi 🇫🇮:

It is a larger discussion but I find it very interesting that some people who called “transparency” with crypto are actually those who are the most opaque by themselves 😅 (if we think of current finance and banking )

Gold Rocket | Satoshi Club:

By the way, why such a name Telos? Who invented?

Mary | Satoshi Club:

Yes, this is an endless discussion, but in this, we can find the truth.

Suvi 🇫🇮:

Danske Bank, Deutsche Bank, and their money laundering and tax evasion. LOL.

Gold Rocket | Satoshi Club:

Awesome👍

Douglas Horn – GoodBlock, dStor:

I named it. Telos means “the ultimate purpose of something” like what it can become.

Aristotle said, “The telos of an acorn is to become an oak tree.”

Gold Rocket | Satoshi Club:

Great character! I wish you strong roots of a dense crown and generous fruits of labor 👍👏👏👏

Mary | Satoshi Club:

Oh, its really deep sense👍

Gold Rocket | Satoshi Club:

Get ready for a storm of questions! 😁😁😁

Mary | Satoshi Club:

Yes, I have one😂 ready for the part of the live question?

Douglas Horn – GoodBlock, dStor:

Yes

Mary | Satoshi Club:

Let’s go 🚀

PART 2.Questions about the Telos project from the live chat of the telegram community.

In this part, we open a chat for the crypto community for 120 seconds. Then the guests from the Telos crypto project choose the top 10 questions. The 10 crypto enthusiasts have earned cryptocurrency in the sum of 100$.

Q – 1 from a telegram user @warny

Do T-Bond NFTs have a face value and can they be traded a number of times?

Douglas Horn – GoodBlock, dStor:

Yes. Each T-Bond NFTs carries a fixed amount of locked TLOS tokens that unlock on the maturity date.

You can trade as many times as you like on the secondary markets and they act like US T-Bills in that as other interest rates change (Telos staking rewards in this case) the T-Bonds can be sold for more or less.

There’s no settlement though, unlike bonds. The owner holds and controls all the TLOS in the T-Bonds they hold. They are just locked to the NFT.

Q – 2 from a telegram user @RosemaryBianco

What will allow Telos transactions to be so fast (0.5 seconds), what would be the value of these transactions? Thx.

Douglas Horn – GoodBlock, dStor:

Again, this is something Telos already does and has without a single Telos mainnet pause for over 2 years now.

The speed is based on the DPoS protocol we use and the high-quality validator nodes required.

Q – 3 from a telegram user @Cakelov

I just wonder, does Telos have an ICO or private sale for TLOS token? Which exchanger that already listing TLOS? Please share the link where to get TLOS, thanks?

Suvi 🇫🇮:

Question number 1: Telos TULIP plan https://telos.net/telos-uniswap-liquidity-implementation-plan-tulip/ explains this very well.

Currently we are trading at Probit, newdex and coin tiger. Unfortunately, our liquidity is quite bad. This is because not many people who has telos, are willing to sell at these prices.

That is why we first arrange T BONDS SALE. This is 25th January, we are waiting for audit to complete.

T bonds will be sold at average market price. If the market price is 4 cents, you can buy for example 100k TLOS at 4 cents. Currently this is not possible without pumping the price like 100%, and no savvy investor/trader does that.

But the number of T BONDS is limited (just because it is such an awesome deal) that is why we organize a separate Uniswap presale after T bonds, and all proceeds will be used to liquidity and exchange listings and MM.

We believe these actions significantly improve telos markets, taking TELOS to the market cap it deserves.

Q – 4 from a telegram user @cengizhantekin

You have an upcoming project called “dStor” which will make you a competitor to Filecoin and Siacoin. What will the unique features of this service be and what earning model will it have?

Douglas Horn – GoodBlock, dStor:

dStor has several unique points over Filecoin, Siacoin’s Skynet & Storj’s Tardigrade.

I mentioned that users can pay for services in fiat with credit cards. That alone opens dStor up to the 99.5% of world users & businesses who will not even consider paying in a token.

Also, on other chains, users make deals with storage nodes to directly host their files. But dStor customers make the deal with the network which then selects nodes all over the world and rebalances them if any go down. It also incentivizes nodes to have high performance so they get paid more. So dStor is inherently an “all-region” service local to anywhere in the world, making it faster, more decentralized & more resilient to disasters or government actions.

Q – 5 from a telegram user @eeaq15

The ETH network is the most famous and used network to date by different users, however, what makes it superior to the TLOS network of the ETH network and why should we stop using ETH for using TLOS?

Suvi:

We don’t think users should stop using Ethereum. I use Ethereum every day (although I don’t like gas fees). But I am big in Defi and this bull run is driven by Ethereum DeFi, until it will reach saturation and can’t take any more new users due to scalability issues. (it is difficult to trade if a transaction fee is bigger than the tradable amount).

We mentioned earlier that different chains have their own advantages, telos is for example perfect for microtransactions that require high capacity. We see that Telos is very well aligned to support a bigger crypto ecosystem, that effectively has one common goal. Some actions are on Telos and some on Ethereum. We think that by collaborating many chains will achieve positive synergies. These are not achieved in isolation. Collaboration only leads to massive growth, for all participants.

Q – 6 from a telegram user @shabeeb6035

Telos runs on EOSIO, which you mention is the fastest blockchain software on the market, but is that the only reason for your decision to work with it? What other characteristics can you tell us about? Would you say EOSIO is the perfect fit for Telos and its users’ needs?

Douglas Horn – GoodBlock, dStor:

We have been building on eosio for almost 3 years (yes, before the EOS launch. I helped launch the EOS mainnet.) It is great software in many ways. The problems with EOS are not the eosio software.

+ Eosio smart contracts are written in C++, a more functional & mucg more widely used computer language than Solidity.

+ eosio compiles to web assembly (wasm) that is faster than Ethereum can be until Ethereum 2.0 phase 2.

+ The network is just massively faster & higher capacity.

+ Accounts have simple names and key abstraction meaning you can change your account’s keys and even assign certain keys for specific purposes without compromising the accounts. This is great for businesses, Dapps, IoT devices, etc.

There are many more examples but these alone are very powerful.

Q – 7 from a telegram user @adamlike

What is the minimum tokens I can buy to get-in Telos ecosystem for staking?

Suvi 🇫🇮:

Any amount 😊 telos REX staking pays now 17% APR.

Q – 8 from a telegram @Maksyrn

Why is TLOS token available for trading only on these exchanges? When will there be others with more liquidity?

Suvi 🇫🇮:

We never had any ICO, and exchanges are expensive. That is why we have now this liquidity sale on uniswap / bounce finance. We will raise funds specifically for liquidity.

Exchanges are chicked and egg issues for projects like telos. They want money and traction, and we need to build value before getting money, traction, volume, and investors. But I think we are quite near that all this is solved.

Q – 9 from a telegram user @kikirush

Can you touch a bit on the Telos community governance, what exactly can the community decide on?

Douglas Horn – GoodBlock, dStor:

Telos is entirely run by its community and they can control everything.

The Telos validators (aka block producers) that operate the chain are elected by the stake-weighted votes of users. This is updated every 2 minutes.

The Telos governance rules called the TBNOA (Telos Blockchain Network Operating Agreement) are stored on-chain and users can propose and vote for changes.

Telos Works is our development fund that users propose and vote on projects with.

And we also make all of these governance tools available for and Telos Dapp to use (and soon any Ethereum dapp using CCI) easily and cheaply. So Dapps on Telos also end up having great governance features including treasury & committee management.

And since it’s free for token holders to vote on Telos, we get better parties than projects where voting has high gas costs.

Q -10 from a telegram user @Maksyrn

I had never heard of the Telos project before. Why is that? What happened during these 2 years? Where can you check out the previous RoadMap, not just starting this year?

Suvi 🇫🇮:

Again we did not have ICO. This means that we didn’t have funds to pay for example crypto influencers (decent budget starts from 50 k USD month)

It would have been a very much easier route for us just do an ICO. This is clear. But I think we have built an ecosystem of massive value and now giving people the opportunity to join.

We have significantly improved the work Block one is doing for eosio. There is a number of solutions that is Telos innovation, for example, steemit like reward mechanism (used by appics.com the best social media platform, telos decide, used by join seeds (and a number of them under NDA), etc.

We see that we actually delivered what block one promised. EOS Network is not doing anything as we do. And we did this all without that 4 billion.

Telos, the chain that made eosio work 😁🔥

Part 3 – Quiz about project

In the final part, we tested the knowledge in terms of the Telos project. They’ve prepared 4 questions for this part, so everyone could be a part and answer. Participants had 10 minutes to answer. 300$ was distributed between the winners.

Our contacts for more details:

English Telegram group | Russian Telegram group | Spanish Telegram group | Telegram Channel | Twitter | Website

Our Crypto Partner by this AMA: Telos

Telegram group | Facebook | Tweeter | Website | YouTube