PART 1. Introduction of Phantasma chain project and community questions.

Hello, Satoshi clubbers and guests of this site. We are happy to present to you Blockchain for next-generation content distribution.

Phantasma chain – is a fast, secure and scalable blockchain solution powered by the governance token SOUL and the energy token KCAL.

The plan of AMA session:

- Part – Introduction and preselected questions.

- Part – Live questions

- The Quiz about Phantasma chain

The reward pool is 800$

Leading the AMA our clever and fun admins:

Mary | Satoshi Club – @madamlobster and D. | Satoshi Club – @Cool_as_Ice

The Representative of the project:

Jay – @senzsze

Joseph Colón – @Joeslanet – TCG with NFTs on Phantasma Chain

Bill Petridis 🇦🇺 (Now also an NFT) – @bpetridis – development operations and senior pre-sales consultant for Phantasma.

Introduction of Phantasma chain project.

Mary | satoshi club:

Hello, satoshi club! We are happy to announce our ama session with phantasma! Welcome to satoshi club😀

D| satoshi club:

Hey everyone 👋

@bpetridis @senzsze @Revoltoso @joeslanet hello guys! Welcome to satoshi club!

Jay:

Thanks d, happy to be here! 🙌

Mary | satoshi club:

Hello, Jay! Welcome to the club😉

Revoltoso:

Hello everyone!

Bill petridis 🇦🇺 (now also an nft):

Great to be here everyone 😊

Mary | satoshi club:

Hello, guys! Almost all are here👏

D| satoshi club:

Good to have you here guys 😃

Mary | Satoshi Club:

Let’s start the party 🚀

Could you please introduce yourself and tell us more about Phantasma?😉

Joseph Colón:

Hello guys! Happy to be here 😉

Mary | Satoshi Club:

Welcome here, Joseph👏

Jay:

I’ll start off by introducing myself and my role in Phantasma 😃

I joined the Phantasma ecosystem as a community manager and part of the Phantom Force back in the autumn of 2019.

I have known Bill and our most insomniac dev Vincent @vgrofll for a long time from other projects and common groups, so it was an easy decision to jump on board and get involved when I saw how far along they were already compared to other projects in this space.

Since then I’ve just become more and more entangled in everything Phantasma, from software testing to strategizing, content creation, website building, marketing, etc 😃

As for Phantasma itself, there is just so much to tell as we have been spending the last couple of years hunkered down in full on #BUIDL mode, but here’s the elevator pitch to get an impression. This is just scratching the surface however 😃

Phantasma (phantasma.info) is a highly scalable blockchain and development ecosystem, built from the ground up for gaming, NFTS, and Dapps. It features tri-chain interoperability across our mainnet, Ethereum, and NEO, built-in oracles, and advanced Smart NFT technology.

With our high capacity, native decentralized storage, and near-free transactions, we feel we are perfectly positioned to provide the technological backbone for the future of gaming, NFTS, and digital ownership in its growing ecosystem.

Phantasma’s NFT self minting console unmint (ghostmarket.io/mint) delivers an immutable touchpoint between artists and their fan base.

We also offer Steam Integration to bridge the gap between mainstream and blockchain gaming via www.pavillionhub.com – this is a one-stop-shop for any gamer, blockchain, regular, or both to link their wallets, steam accounts, and NFTS and utilize their gaming property.

The key takeaway from all of the above, is all of this works, right now, we pride ourselves on building first then advertising. We have a very strong and growing user base and feel that is the key element to our ongoing relevance.

Mary | Satoshi Club:

Oh, you are as a family member there😂

Jay:

Pretty much yeah, and that is part of what makes Phantasma so awesome, it just feels like family. And that doesn’t just apply to the team, but it extends to the rock-solid and knowledgable community surrounding everything Phantasma does. We’re extremely open to community feedback, and a significant amount of the massive upgrades implemented on Phantasma with regard to features, UX, etc have been born out of community feedback 😄

Joseph Colón:

I’m part of a team that is building a game that is powered by Phantasma. When looking for the ultimate blockchain for our game, as we made a lot of research and came to the conclusion that Phantasma is the best choice. We needed to make sure that we were using technology that allowed us to take our game mainstream and for players who are not familiar with blockchain to get started as easily as possible. For anyone here that is interested in developing a Dapp or a game, I’m happy to answer any questions you might have.

Mary | Satoshi Club:

Nice! It’s really exciting to see that the game industry now more and more involved in blockchain 👏

Bill petridis 🇦🇺 (now also an nft):

I’m the development operations and senior pre-sales consultant for Phantasma. How I ended up in this position is a semi-interesting story. Experience wise, I have been in enterprise software in varying capacities for 20+ years, delivering E-Commerce, Document Management Systems, and Content Distribution Solutions. I’ve done everything from technical analysis, dev-ops, development, solution architecture. Feel I’m putting you to sleep – I’ve been around the block a few times, in short 😊, have worked for Oracle and a lot of large organizations in Australia, and was even assigned to Obamacare for close to a year.

I’ve been involved in crypto for 5 years and about 3 years ago started assisting a close colleague in finding a blockchain meets the objectives of the team behind www.22racingseries.com. Eventually, I found Phantasma.

Since then I’ve become increasingly involved with the project to the point where I currently function in the capacities above. It’s a slippery slope.

Mary | Satoshi Club:

Cool background, sure you will help a lot to build an excellent product 👍

D| Satoshi Club:

So games and NFTS are your main directions?

Bill petridis 🇦🇺 (now also an nft):

No, but it is one of our strengths given the capabilities of the naturally lend themselves to mainstream economic layers of games. We also have a strong focus on Dapps, interoperability, application of our NFT tech to many use cases and tools. This covers everything from the ability for users to mint their own digital assets, wrapping complex, layered assets for privacy and transfer, insurance – I’ll talk to this more. To put it simply, our tag line pretty much sums it up. Phantasma, next-generation blockchain and ecosystem for gaming, NFTS, and Dapps. We connect, you create and control. It’s all about flexibility, cost-effectiveness, and easy to use means for users to leverage our offerings.

Jay:

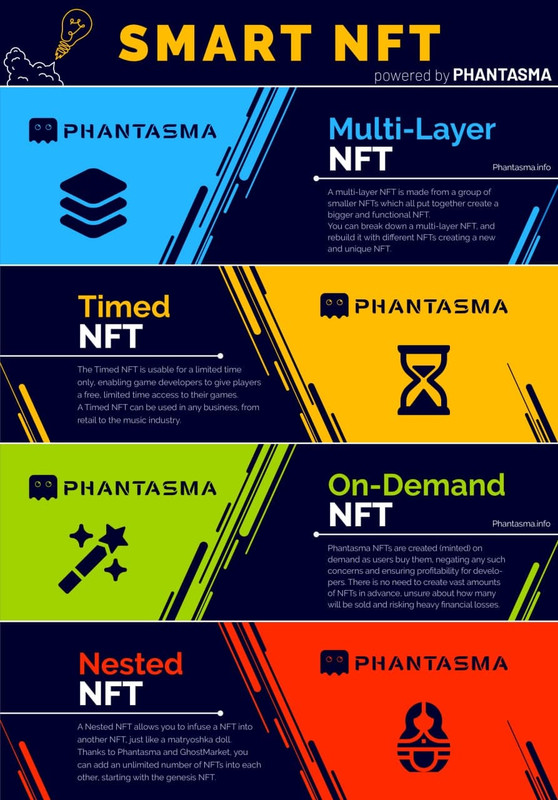

Considering our NFT standard received a MASSIVE upgrade as late as this December where we upgraded to a whole new NFT standard you could say that yes. NFTs are relevant for both art, games, and half a million other use cases and are gaining more and more attention in this space – as they should. Phantasma Smart NFTS has a whole host of highly advanced features that you will not find in combination on any other platform.

D| Satoshi Club:

Sounds awesome, to be honest, 😊 can’t wait to find more about it 😉

Jay:

Actually, let me dive into some of the exciting features of a Phantasma Smart NFT, it’s something that really deserves to be covered in full – and properly digested 😄

I’ll go through the main features for a Smart NFT, and leave it up to each and everyone to decide its level of awesomeness 😉

Interestingly, our advanced Smart NFT technology is one of the features that has attracted the most interest from other project teams and has given birth to multiple current partnerships as well as a couple that is still under wraps while we establish the scopes of our collaborations.

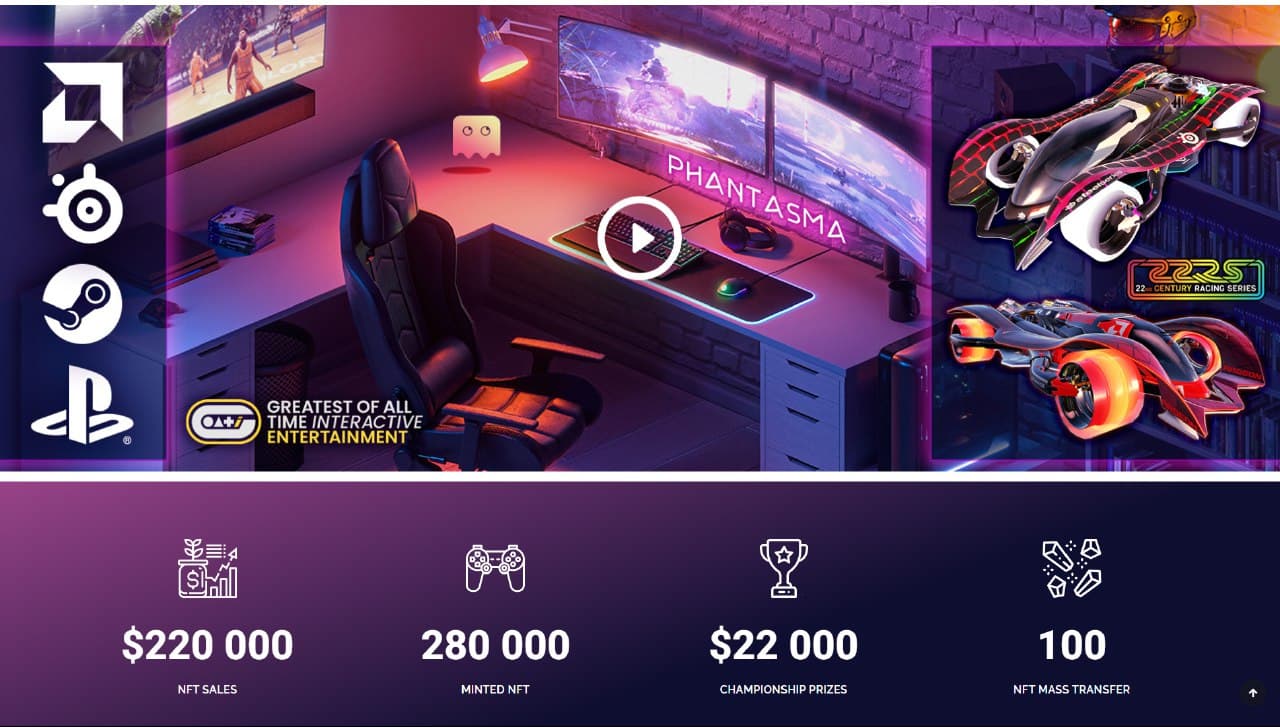

#1– Multilayered: A Phantasma Smart NFT can be composed of an unlimited number of NFTS. This feature is already in use by our gaming partner goati in their real-time strategy racer 22 Racing Series (www.22series.com), where every single hypercar that you car race at upwards of 1000 kmpl in-game is composed of 20-30 different individual NFT car parts.

Inside the game, the cars can be broken down into their individual parts, mixed, and reassembled into a hypercar NFT again. This is groundbreaking and basically unheard of in the NFT space.

#2-Timed NFTSDuring the gaming convention PAX Australia last autumn our partner goati premiered a world first with their time-limited game licenses – an NFT distributed to the gamer’s wallet which gave full access to their game for the duration of the gaming convention, but no longer.

This opens up the possibility to “try before you buy” without limitations, providing access to music, movies, or other content for a set amount of time (rent a movie for the weekend? Get a 7 day unlimited Netflix access? Timed software licenses?

Jay:

#3– Minting on-demand: On expensive and slow blockchain platforms it’s common for the NFT minting process to take up to a couple of days, and if there’s congestion you’ve got the choice between paying exorbitant fees to get something quickly or wait it out until the chain is calm again.

On Phantasma, developers and artists don’t have to wait, and nobody has to pay insane fees in advance without knowing whether they will even sell their goods.

Instead, the moment a purchase is made by the customer, the NFT is minted instantly at the cost of a fraction of a cent to the developer and delivered straight to the customer’s wallet. This provides a smooth user experience and avoids fleecing developers who just want to create cool stuff.

D| Satoshi Club:

Yes, I actually want to try to create NFT on Ethereum, and place it on open-sea but it’s impossible with these gas fees. I’m almost waiting for 2 weeks now 🤣

Jay:

Ghostmarket.io/mint is your new best friend 😘

D| Satoshi Club:

Thanks! 😁

Jay:

#4 – Nesting and multi infusion of assets: On Phantasma, you can infuse assets inside your NFTS to give them a baseline value, or to create a bundle of things you want to sell for example.

You can infuse 100 SOUL, 50 KCAL, 1 ETH and for fun 2 NEO too into the same NFT if you want, there are no limitations. Not only that, but you can infuse an NFT into an NFT, providing opportunities for treasure chests and tons of other use cases.

Already, we have artists who infuse related artwork NFTS into a single NFT and put them up for sale as a bundle at a discount – like here (note the “infused” section and browse it):

But being Phantasma, we don’t stop there. That NFT you infused with another NFT? You can infuse that into yet another NFT. Think NFTs infused into NFTs infused into NFTs infused into… You get what I’m saying. Nftception – no limits 😎

One other I have to mention is an artist who recently joined our ecosystem, who has been minting tickets for a live concert bundled with his album and more and infused all of this as separate NFTs into his NFT – have a look here:

Jay:

#5 – can’t forget this as we’re aiming for another world first here 😄

– Cross-chain NFT swaps: The Phantasma Smart NFT standard is compatible with Erc721 and Erc1155 allowing us to work on cross-chain NFT swaps (will be another world first), which means that artwork, game items, music, etc minted with super low fees on Phantasma can flow over to Ethereum to NFT marketplaces there and Eth Dapps in addition to ETH NFTs flowing the opposite way, paving the way for another level of interoperability.

Of course, whenever you want

Jay:

Bill may want to mention goati here which is a prime example of how game studios find solid platforms and partnerships happen simply because they make a ton of sense for everyone involved

Mary | Satoshi Club:

You’re partners with them almost for two years, right?😉

Jay:

Since kindergarten more or less – I’ll let @bpetridis cover that bit 🤪

Mary | Satoshi Club:

Sure👍 Very cool👍

Bill petridis 🇦🇺 (now also an nft):

Yes, but I’ve also worked on and off with the team behind it as it’s been their pet project for nearly ten years now. I’ve known the lead from that studio for even longer. We are close friends and as above, their need to fill that last remaining part of their dream with 22series.com needed blockchain and especially one that was fast, flexible, cost-effective, and richly featured, especially in the NFT area. In collaboration, we’ve also launched a one stop shop gaming hub that functions like Steam (it even interacts with Steam – www.pavillionhub.com) and allows users to connect their wallets so they have a single entry point to both their blockchain and regular games. I Will get into detail there are a bit later.

Mary | Satoshi Club:

Oh, it’s really nice to have such friends 👏

Bill petridis 🇦🇺 (now also an nft):

Very handy indeed. What they’ve managed to do IMO is second to none in the blockchain space – also my cat enjoys it.

https://youtu.be/a68zCe1H-oQ

Bill petridis 🇦🇺 (now also an nft):

I have quite a fun video of him sitting on my gaming room floor putting me to shame. Guess I can share that later 😊

Jay:

To sum up, the awesomeness, lest it drowns in words 😉

Mary | Satoshi Club:

Perfect visualization 👍

D| Satoshi Club:

And awesome variety

Jay:

Oh, and with regards to goati and their work that Bill has been mentioned – one hyper-relevant thing today is that it’s the last day of the last auction in the first chapter of the partnership between Travala and goati – getting your hands on this car will earn you the right to race the founders of Travala for some awesome prizes – just another example of the cool synergies that can be achieved when good people find each other in this space 💪💪

Less than 12 hours to go until the @travalacom sale period ends 😲

Last chance to pick up an #NFT vehicle that'll give you access to the #prized #esports tournaments.#Vehicles can be discovered in limited edition part packs, or in the final #Auction 🧐https://t.co/M56xWTkxyT pic.twitter.com/WrSmGAmpJN

— Pavillion (@Pavillionhub) January 22, 2021

Mary | Satoshi Club:

Oh, I saw this twit today👍

Jay:

I kind of get carried away talking about Phantasma these days – we’re in the process of opening the floodgates and have so much to show the world 😂

Mary | Satoshi Club:

I see that you achieved a lot! And I am sure it’s just the beginning 🚀

D| Satoshi Club:

Thank you guys for this really impressive intro! 👏 are you ready to begin the first part of our AMA? 😄

Jay:

Fire away, uncle Bill’s old fingers will keep tapping away at that keyboard 😄

Preselected questions about the Phantasma chain project.

D| Satoshi Club:

Q1 from Telegram user @Arisabela

The Phantasma app aims to be advanced but at the same time, a user-friendly solution to people connect their daily used apps with blockchain, when you say user-friendly it means it is a good option for beginners? Do you use any type of guidelines for inexperienced users?

Jay:

I’ll take that one 👌

Hi there @Arisabela, thanks for asking!

At Phantasma we like to say that mainstream adoption begins when grandma can use blockchain Dapplications in her everyday life without even knowing it. That is why we focus a lot of energy on user-friendliness, making sure Phantasma’s advanced features are accessible to even those who are just starting out exploring this technology.

As an example, our Poltergeist wallet has simplified seamless cross-chain swapping technology across three separate blockchains to a simple “button click procedure”. The same applies to staking, creating your own NFT artwork on ghostmarket.io/mint, our oracles work silently in the background and the users simply see that “Oh wow, this works – and it works WELL!”

Similarly, at the risk of repeating myself, game studio goati who have created www.pavillionhub.com, the blockchain-powered and Steam connected game hub on Phantasma, have done so with minimal friction / no stress Steam like user experience in mind, only with all the added features and advantages that blockchain technology can bring to gaming.

Of course, we recognize that there are still obstacles to mainstream blockchain adoption, but we’re on the right path and hellbent on removing them, grandma will go on-chain 😄👌

Mary | Satoshi Club:

Yes, I downloaded Poltergeist today😂 it’s so cute

Jay:

I like you already! 🤗

Make sure you join the NFT giveaways on Twitter https://twitter.com/phantasmachain – and send me a DM afterward if you need a little KCAL to test the self minting service, Unmint 👌

Https://twitter.com/phantasmachain

Mary | Satoshi Club:

Still didn’t, but I will✅ thank you😂

Bill petridis 🇦🇺 (now also an nft):

Thanks for that feedback 😊 we’ve purposely kept it minimalistic as the UI is meant to emulate an almost gaming like user experience.

Mary | Satoshi Club:

But, guys, I need to say that I am still not sure about grandma😂 but the industry really made great steps in the mass adoption direction! And Phantasma helps us!

Jay:

Grandma ain’t here yet, but she’s coming – we’ll make sure of it💪

Mary | Satoshi Club:

Be sure, when I will be grandma 😂 I will use it) actually, I already start👍

Thank you, guts for your answers! We have some more questions in this part! Should we proceed?

Bill petridis 🇦🇺 (now also an nft):

Go go 😊

D| Satoshi Club:

I think your project is a perfect point to start for beginners. It will be much easier for them to dive in cryptoworld with Phantasma 👌

Jay:

That’s kind of the whole point of Phantasma – you’re not supposed to need a PHD in Geekiness to get involved!

Joseph Colón:

Mainstream adoption will come when the end-user does not even have to think about what is running in the backend. We all use the internet and apps daily, but we don’t think what tech is in the backend. All we know is that it works. This is the same with Phantasma, it just works and the team is doing their best to make the user experience as good and easy as possible for anyone.

Jay:

Fire 🚀

D| Satoshi Club:

Absolutely agree!

Q2 from Telegram user @yellowchamp

One of the Phantasma core features is having a dual token system which is the $SOUL and $KCAL. So with these two tokens, what advantages did it brings to the Phantasma ecosystem? Any reason for having two tokens for Phantasma? What are the uses and governance of these two tokens in your platform? Did this token is dependent on each other? Thank you

Mary | Satoshi Club:

Yes, it’s a question I was waiting for😉

Jay:

Ohoh, I’m a tokenomics and use case nerd, i’ll have a go 😃

Haha, this is actually a huge question @yellowchamp which deserves an answer in several parts. One of the major advantages is having a dual token system is that we can enable token holders to actually use the ecosystem without continuously burning their own token holdings.

In addition, if you compare to the unfortunate fee situation on Ethereum with its massive spikes, having a dedicated fuel token generated by staking the governance token allows us to ensure that transaction costs stay super affordable even during high traffic scenarios. Now, let’s have a look at the separate use cases of SOUL and KCAL first:

Jay:

SOUL is the governance token of the Phantasma blockchain, and the evolution of Phantasma is driven by the SOUL holders. There are multiple benefits awarded to SOUL holders:

– Staking SOUL generates the fuel token KCAL and enables you to claim your Phantasma name on the chain so that Bill can send funds to Rob instead of p2kjme8w1…Ju4D4nWmm. Stake 50k SOUL to earn the title of Soul Master and get an equal share of the 125k monthly SOUL dedicated to Soul Masters. We also introduced CROWN nfts last month and backdated their distribution. These are allocated to anyone that has been a SOUL Master for three months and having a CROWN in your wallet increases your ability to generate KCAL by 5%.

– Your decentralized Phantasma storage allocation, served by the block producers, is also proportional to and growing with your stake. SOUL enables you to securely store your most precious files – encrypted, of course.

– SOUL sustains the entire ecosystem through its low 3% annual inflation with 2/3 allocated to block producers and 1/3 allocated to the decentralized Phantom Force.

– All of this is geared towards less SOUL in circulation and an emphasis on long term token holder retention. We pride ourselves on holders using the chain rather than flipping their tokens for gains as that somewhat defeats the purpose of being a blockchain solution provider.

Bill petridis 🇦🇺 (now also an NFT):

Yes, I was going to chime in on that, it allows us the flexibility to keep our fees forever low. GWEI cost these days is a big sticking point for many that use ETH, myself included. I love ETH, we spent months building the swapping, just unfortunate about the fees, so we have structured ourselves to avoid that.

Jay:

KCAL fuels everything in the Phantasma ecosystem and is needed for every single type of transaction on the blockchain, giving it a wide range of use cases.

– From simple transactions to staking, minting your own nfts or claiming KCAL itself, everything requires a minor fee – payable in KCAL and nothing else.

– Developers deploying smart contracts and new tokens pay their fees in KCAL exclusively.

– To generate KCAL it’s necessary to stake SOUL. For each SOUL you stake, you generate 0,002 KCAL every single day – for a 1,000 SOUL stake, that’s 2 KCAL free every day, enough to cover all normal transaction types for the average user in perpetuity.

– Deflationary measures guard the KCAL token economy, with half the KCAL fee of every type of transaction being burned instantly – keeping inflation under control and providing balance to supply and demand.

– Even Dapp developers are contributing, with ghostmarket burning half their earned KCAL fees, further driving a downwards pressure on the KCAL supply.

Jay:

So basically we don’t create tokens to yield farm something worthless and mint in infinity (cough cough). We have a token system where each of our two tokens has a massive suite of use cases that’s being continually expanded. We created them both because we actually need them and want to see them flowing across the ecosystem through our Dapps and marketplaces 👌

Mary | Satoshi Club:

Yes, I tried some functions in my wallet, and they requested me to own SOUL as I remember 😀

Jay:

I’ll send you a couple – we need the ‘Mary’ Phantasma on-chain wallet name locked down 😃

Mary | Satoshi Club:

Oh, thank you 😂

D| Satoshi Club:

“- To generate KCAL it’s necessary to stake SOUL. For each SOUL you stake, you generate 0,002 KCAL every single day – for a 1,000 SOUL stake, that’s 2 KCAL free every day, enough to cover all normal transaction types for the average user in perpetuity.” this model reminds me a NEO model a bit, with their Neo Gas token.

Jay:

Yes, it has some similarities with the NEO:GAS relationship, it’s probably the easiest ‘intro’ for those not familiar with Phantasma to think of it as a similar relationship.

Bill petridis 🇦🇺 (now also an nft):

Also has a lot of similarities with the EOS structure in that regard.

Mary | Satoshi Club:

Btw, are both tokens listed on exchanges?

Jay:

Indeed they are – SOUL’s primary liquidity is found on Kucoin (www.kucoin.com) with its BTC and ETH pairs, it’s also listed on Uniswap, slippage would be greater there. We’re in the process of implementing a pretty darn cool and innovative liquidity incentivization for Uniswap with a nifty cross-chain element to it, watch that space 😄

As for KCAL it’s on Uniswap in its ERC20 form with decent liquidity – head over and have a look: https://uniswap.info/pair/0x57db2a0d2231fe522ed5d1cb40458ac152b41e01

Mary | Satoshi Club:

Wow, interesting structure 😀

It seems easier to get SOUL then KCAL with gas fees nowadays 😂

Jay:

Actually, it’s easy to get both – you get SOUL and then you stake it – voila you have KCAL every day 😄

Mary | Satoshi Club:

I think most users are familiar with ETH, but for sure we also have EOS users here😀

That is what i mean😉 Thanks, guys for these informative answers! Everything seems easy and clear!

Ready for the next question?

Bill petridis 🇦🇺 (now also an nft):

Sure thing

D| Satoshi Club:

Let’s go! 🚀🚀🚀

Q3 from Telegram user @Wormz28

A few days ago, Phantasma proudly announced a strategic partnership with DeFi insurance provider polka cover, and polka covers platform aims to offer a frictionless insurance marketplace building on Polkadot. So what is the purpose of this partnership? Is this also your way or your bridge to open your ecosystem to Polkadot Dapps and users? Lastly, what are the innovative new products the Phantasma and polka cover will build around the NFT marketplace?

Jay:

It’s an interesting point though. Phantasma has tri chain interoperability, we have perpetual bidirectional 1:1 swaps between NEO, Phantasma, and Ethereum. NEO and GAS along with SOUL can flow between NEO and Phantasma, and ETH, SOUL, and KCAL can flow between Phantasma and Ethereum. Later we’ll add more tokens including stablecoins, this is technically trivial as we have all the cross-chain architecture in place already.

What every single Eth user who buys Our ERC20s on Uniswap and moves them over to Phantasma complains about is gas fees – and how much faster, cheaper and smoother it is when the assets come back home to our mainnet 🤠

And on a related note, it’s actually possible to make crazy cheap transactions with Eth – around $0,00005 per transaction. You just swap your ETH from Ethereum to the Phantasma mainnet native ETH first 🤓👍

Mary | Satoshi Club:

I should try it myself 👍 i like such things!

D| Satoshi Club:

On Ethereum we should pay for every move😄

Jay:

Bleed till you’re dry 😅

Of course, that is a metric to show that Etehereum sees a lot of use, and that is a good thing both for Ethereum and for the space as a whole, so one should not purely see it as a negative thing

However, there is no way on earth you will have the average gamer for example pay $5-$50 every time he wants to move his in-game asset to another wallet – or to receive it at all – just as an example

Bill petridis 🇦🇺 (now also an nft):

I jumped the gun on this earlier from reading and writing about it in the last 20 minutes, mainly because I’m very hands-on with that partnership and it’s one I am very motivated by 😊 as it also adds to our services and further interoperability with the Dot ecosystem. The partnership objectives are to provide joint insurance offerings for areas of concern like impermanent loss. For example, say I infuse 10 ETH into an NFT so that the NFT is considered a share or security (yes that’s something we are doing also, just not with polka-cover) then ETH has a massive crash while it’s up on the marketplace or locked in a contract. You are kinda stuck, if you burn the NFT to retrieve your tokens you’ll have a nasty case of impermanent loss on your hands. The objective of this partnership is to package NFT based insurance offering for protection against such loss with revenue sharing across both parties. We also intend it to further grow our already growing connections to the Dot Ecosystem. Their relay and Parachains are very much like our native side chains so we see a lot of synergies and wish to explore that to it’s full potential. More reading below. Also want to emphasize that It’s a very collaborative, active and solution focused partnership, a lot more than the average handshake/article 😊 https://medium.com/phantasticphantasma/polkacover-x-phantasma-af411423bdff

I feel strongly about providing coverage for our growing userbase. Feel it will allay any concerns users might add when minting valuable digital assets, or purchasing allocations of offerings on our chain and/or transporting them over to another chain and further assist with adoption.

Mary | Satoshi Club:

Is this insurance already working?

Bill petridis 🇦🇺 (now also an nft):

We have all the technical ingredients to offer it, so it’s now a matter of finalising the financial structure of it all, upfront and ongoing updates to risk profiles for insurance underwriters. Said underwriters have already been locked in, will have full transparency and will continue to adjust their coverage of the coverage as the NFT space matures.

Mary | Satoshi Club:

Thank you! We all are waiting for this!🚀

Bill petridis 🇦🇺 (now also an nft):

Strongly believe it’s something that is sorely needed, especially as mainstream use and legitimacy of crypto grows.

Mary | Satoshi Club:

It’s extremely needed 😉 Ready to proceed with the next question?😀

Jay:

Gogo

D| Satoshi Club:

Q4 from Telegram user @borysfireball

We say that everything is learned in comparison. So I compared Phantasma to WAX. You had approximately the same starting positions: WAX ICO (17/11, $ 9.6mln), Phantasma ICO (18/05, $ 9.65mln), NFT oriented, according to ICO Drops data. Today, for example, the atomic market (WAX) is ranked # 1 in the marketplace according to dappradar.com data (5.31k users, 273.68k volume weekly). Sadly, but I can’t find Ghostmarket data on this popular resource. Could you show us user statistics and tell us about the current state of affairs. Thank you.

Jay:

Hi there @borysfireball!

Comparing projects with each other is a popular exercise in crypto that has both its strengths and its pitfalls. First of all, you need to have metrics available that enable such a comparison. On that note, Ghostmarket launched in late December 2020 which means it has only been live for a single month. During that short amount of time, we’ve seen some solid launch stats!

– 6000+ NFTS minted

– 100000+ $KCAL burned (50% of the mint fees), close to 2k USD

– 26k USD trading volume

…and a ton of updates, and way more to come very shortly, with NFT auctions coming up!

We’re listed in the NFT category on CMC, coingecko, and will be listed on staking rewards. We are principally opposed to paying to have information published which the publishers also derive income from.

Some sites do charge more than a pretty penny to integrate project data, and those we’ll consider at a later point in time when they come to us asking to integrate Phantasma instead of the opposite 😃

For current Ghostmarket stats have a look at https://ghostmarket.io/statistics/ – multiple new artists have been onboarding weekly, and we’re seeing a type of organic and aggressive growth that makes us proud and confident in the path we’re on! 🚀

Mary | Satoshi Club:

Dapp radar is charging a payment for listing?🧐

Jay:

Got to ask dappradar about details there 😃

Mary | Satoshi Club:

Got it😂

D| Satoshi Club:

Great! You just at the beginning of your journey! I want to be an early adopter then😄

Mary | Satoshi Club:

Been an early adopter always brings good harvest😉

Jay:

Suffice to say there are a lot of services in this space that are pay-to-play, which provides an unnecessary obstacle for new people to get a proper and unbiased overview of what this space has to offer

Not an issue for Phantasma though, we’ve been approached from all directions for some time now and are building those proper business partnerships 😉

Mary | Satoshi Club:

Actually, I was working on one blockchain project before and I know what are you talking about 😂 Prices were awesome 🤣

So, guys, I am sure that you will have a lot of users soon! Also, I am sure that our Satoshiclubbers will join Phantasma 🚀🚀🚀

Joseph Colón:

All are more than welcome and the Phantasma community is very open and friendly, eager to help everybody who has a question.

Mary | Satoshi Club:

Ready for the next question?😉

Joseph Colón:

Shoot 😉

D| Satoshi Club:

Q5 from Telegram user @Brainchest

I am interested in the process of creating an NFT. A car or other complex mechanism that has several different characteristics. In Decentraland, Sandbox there is a special program for Voxel construction, but how can I make such a three-dimensional object on Phantasma and how much will it cost me to create such NFTS?

Joseph Colón:

Hi @Brainchest

Thank you for your question!

Ghostmarket just recently launched their umint NFT Factory which allows anyone to easily mint their own NFTS for as low as $0.20. This fee includes the platform fee, network fee as well as the fee to list the NFT on the marketplace itself. So as you can tell, it is very cheap and accessible to use for anyone who is interested in minting their own NFTS.

On Phantasma you can also spin up your own contract to mint NFTS on if you are interested in creating your own art collection and $BRAIN token for example. This can also be used for your own projects, such as a Dapp or game, or just to simply have all your NFTS under your own branded token.

As for a special program to create your art, it is up to you how you want to create your art. You can create something using Photoshop, Blender, Canva, or any other tool that artists normally use. Even photography or actual physical paintings can be minted as NFTS, so the sky is the limit. Ghostmarket allows you to easily upload this artwork to the platform to mint NFTS and sell on the marketplace. It also has a “Locked Content” part where you can add a link to a private Google drive or dropbox where the owner of that NFT only can unlock access. You can place the original files there that are very large in size for example, or just unique things that you want to provide the owner of the NFT as a bonus.

Phantasma NFTS has the most advanced NFT tech in the crypto industry, so as far as creating complex mechanisms in the NFT itself, you have a lot of options that just are not possible on Ethereum or other chains that offer nfts.

Http://www.ghostmarket.io/mint

Mary | Satoshi Club:

We can find this umint NFT Factory on Phantasma website?

Joseph Colón:

Www.ghostmarket.io/mint

Apologies, forgot to include the link 😉

Mary | Satoshi Club:

Everything seems easy, so, i am waiting for @Brainchest NFT🤣

Thank you, guys!

And are you ready for the 6th and last question from this part?😉

Bill petridis 🇦🇺 (now also an nft):

Yes 😊

Joseph Colón:

In order to mint, you would only need to connect your Phantasma wallet to Ghostmarket. Get your wallet here: https://phantasma.io/wallets

Poltergeist is a desktop and mobile wallet.

Ecto is a browser extension wallet like Metamask

Mary | Satoshi Club:

Perfect 👏

D| Satoshi Club:

Q6 from Telegram user @konditer_rolex

It is very interesting, therefore, your wallet is called Poltergeist, what functions have you provided, and how different are the capabilities of a mobile wallet from a desktop one?

We already talked about your wallet today, but I sure you have something to add 😊

Bill petridis 🇦🇺 (now also an nft):

Hi @konditer_rolex,

The key difference is that it provides an easier user experience with one click buys on a desktop when using online stores that offer Phantasma payments – here is an example https://www.pavillionhub.com/app/#/store. We achieve this with the Phantasma link and it’s somewhat easier to import your wallet into ghost market and Pavillion on a desktop. Otherwise, it’s the same product as it’s containerized in Unity. As Joseph said earlier, we also have a very powerful and user-friendly Chrome browser add-in that functions like Metamask called Ecto. As above all information is here, downloads, tutorials, the works. Www.phantasma.io/wallets

Also, a good video to see Poltergeist and Phantasma link in action on a desktop can be found here: https://youtu.be/pg6l6mlocdw

Mary | Satoshi Club:

All guides are ready🚀 great job👍 Btw, does it have only an English interface?

Bill petridis 🇦🇺 (now also an nft):

Ecto is already going multilingual, we’ve built German support and are rapidly adding other languages. We are focusing on that first.

Jay:

Poltergeist yes, Ecto is in the process of getting support for 9 or 10 different languages, and Ecto is perfect for everyone who is familiar with Metamask from Ethereum 👌

Bill petridis 🇦🇺 (now also an nft):

Lol – I just did a repeater 😊

Mary | Satoshi Club:

Gotcha 😀

Joseph Colón:

The team is working on adding more. I believe for Ecto they are working on German, Chinese, Dutch, Italian, Turkish, Vietnamese, Japanese, and probably more that I don’t know about :p

Mary | Satoshi Club:

Don’t worry, guys, we have the same with @Cool_as_Ice 🤣

D| Satoshi Club:

Haha it happens sometimes

Mary | Satoshi Club:

Thanks! Sure, you will add as much as possible soon!

|D Satoshi Club:

Thank you guys for amazing answers in this part! Ready for part 2?

Bill petridis 🇦🇺 (now also an nft):

More this, Ecto’s support of multi-byte character sets makes it very flexible. We just need more translators, if anyone is interested please hit us up on our channel 😊

Mary | Satoshi Club:

Oh, you will find translation support, I am sure 👍

Mary | Satoshi Club:

So, live part, guys?😉🚀 Because I can talk with you more and more, but I know our users are waiting for their questions 🚀

Joseph Colón:

Sounds good 😀

Mary | Satoshi Club:

Let’s go 🚀

Revoltoso:

Sure. Let’s do it.

PART 2.Questions about the Phantasma chain project from the live chat of the telegram community.

In this part, we open a chat for the crypto community for 120 seconds. Then the guests from the Phantasma chain crypto project choose the top 10 questions. The 10 crypto enthusiasts have earned cryptocurrency in the sum of 100$.

Q – 1 from a telegram user @cryptovgh

Although POLKACOVER is a partner on PHANSTASMA, we cannot see POLKADOT as a PHANSTASMA’s ecosystem. Why haven’t your ecosystem will supports on POLKADOT? Do you have any future plans to work on the POLKADOT blockchain also?

Bill Petridis 🇦🇺 (Now also an NFT):

The parachain these products are offered from are the very thing we are integrating as part of this partnership, we are also doing similar work with Bondly so that we can offer these solutions as NFTs, we can support any token we like and swapping/NFT infusion makes this all quite a lot easier to deliver.

Q – 2 from a telegram user @cryptovgh

What is meant as PHANTOM FORCE? Is it only your project team or can we join with PHANTOM FORCE? Explain a little bit about PHANTOM FORCE?

Bill Petridis 🇦🇺 (Now also an NFT):

It’s an open-source, Phantasma funded group of developers and development teams. This is how we’ve been able to grow significantly over the last year in terms of our offerings. Always better to have multiple streams of decoupled work happening all at once.

Q – 3 from a telegram user @lzamg

Three of the use cases of Phantasma are eCommerce, Social and Media. Nowadays is hard for everyone to start a profitable business from scratch. So if I want to start my own business and combine the three previously mentioned features of Phantasma, is it possible to build a successful business? Do you encourage small entrepreneurs to consider the possibilities that Phantasma offers for their businesses?

Bill Petridis 🇦🇺 (Now also an NFT):

I do purely on the basis that it’s cheap, highly flexible, and very user friendly. You won’t go broke trying on our solution suite.

Q – 4 from a telegram user @Amila19932

SOUL Token can be staked according to your website, But I could not find more details on SOUL staking, Could you please explain about SOUL staking? How much of SOUL will be needed as the minimum amount and what will be the rewards?

Bill Petridis 🇦🇺 (Now also an NFT):

You need 2 or more SOUL. Rewards are a combination of KCAL and SOUL if you become a SOUL master which also makes you eligible for a block producer spot. All the current statistics are here: www.ghostdevs.com

Q – 5 from a telegram user @Beterror203

Hello, @bpetridis @Joeslanet Music undoubtedly moves the world but now with the pandemic these events are suspended in many countries the artist who made world tours no longer does them until this problem is solved as Phantasma with SOULChallenge leads or offers a solution to this problem to new artists who They were affected by this, what solution do they have to motivate the artist to move on despite these problems that undoubtedly affected the planet?

Joseph Colón:

Thanks for your question.

You are correct that the pandemic has caused a lot of stress for musicians, especially those who rely on live venue performances. Even before the pandemic though, musicians have been facing issues with DSP’s (aka Streaming Music services) that are not providing good benefits for the musicians. Their songs can be played thousands of times and in the end only earn cents. This is not good for the musicians at all who sometimes struggle to make a living off their musical art.

This is why Phantasma started the #SOULchallenge which is an effort to get musicians to start minting their music as NFTs. This will allow them to get 100% of the profits from selling their music to fans, and they can also set a percentage royalty on further sales of that NFT.

NFTs are a powerful tool that allows musicians to finally take back control of their music, and they can incentive fans to purchase the master quality files that are not available on streaming services. I recommend everyone to check out this video made by HouseOfNFT who is a musician himself. He is leading the SOUL challenge to get other musicians to use the GhostMarket platform to mint their own music NFTS.

Q – 6 from a telegram user @Jolly64

Because of the large-scale theft in cryptocurrency today we need to know about these details do you have any investors? Is there any public or private sales?

Bill Petridis 🇦🇺 (Now also an NFT):

There was an ICO, 3 years ago, since then we’ve been extremely successful at managing our funds, and between revenue from our working dApps and partners, along with mild annual inflation pegged at 3% per annum we are set to keep going indefinitely. We are self-sufficient now.

Q – 7 from a telegram user @Jolly64

What is the advantage of SOUL being backed by energy token KCAL in the interoperability area and what solutions are implemented in the field of scalability?

Bill Petridis 🇦🇺 (Now also an NFT):

I think Jay covered it earlier, it’s a combination of speed and the ability for us to keep our fees low.

Q – 8 from a telegram user @KhaleesiTheCryptoLady

Do you have in-game cards, and also do you have a plan to add up more assets like skins, characters, and equipment to your platform? In your point of view, how may blockchain technology influence the gaming world?

Joseph Colón:

Hi Khaleesi!

Thanks for your question.

The game that me and my team are working on is in fact a trading card game. It’s a roleplaying game like Magic The Gathering mixed with Dungeons and dragons. NFTs allow you to create any type of game assets which can be skins, characters, equipment or weapons… the list goes on. Since Phantasma has advanced NFT technology, this means that game developers can leverage the technology to create even cooler types of game assets using NFTs.

I personally believe that NFTs are going to be the standard for game items and assets in the future. We are just at the beginning here, and as NFTs become more popular, and more game developers start providing true ownership of game items to the players, we will see huge growth and mass adoption of blockchain technology.

Bill Petridis 🇦🇺 (Now also an NFT):

We have both. One very cool one is this, which is a deck of cards that are an NFT that performs a roll of the dice when unlocked to provide 5 vehicle parts packs that are also NFTs and a chance to also unlock a vehicle. We also have Blood Rune coming which is a hybrid blockchain/online/physical cardboard game in the pipeline. https://www.22series.com/part_info?part=33554436

Q – 9 from a telegram user @wonderkit

How is the Phantasma NFT made and can it only be purchased in the Phantasma or Opensea

platform market or is there another way to own a Phantasma NFT?

Joseph Colón:

Currently, we have www.ghostmarket.io where you can mint Phantasma NFTs. You can also create NFTs outside of the platform on a chain level, if you want to deploy your own contract.

OpenSea is an Ethereum marketplace, but Phantasma is working on cross-chain NFT swap technology so will soon be able to swap your Phantasma NFTs to Ethereum to list them on Opensea, or the other way around of course, where ETH NFTs can be swapped to Phantasma to utilize the fast network and cheap fees.

Q -10 from a telegram user @Xusuo

I read from your gaming partner GOATi that they already use your new feature ‘Phantasma Smart NFT in GOATi real-time strategy racer 22 racing series. Can you tell us what new feature is this like? How does it work?

Revoltoso:

Hey Icy, thanks for your question. GOATi and Phantasma have a strong partnership that help them both evolve. GOATi developed one of the first AAA video blockchain-based video game called 22 Racing Series. Before starting implementing the blockchain technology into their game, they’ve looked into many blockchain solution, but none was offering them the optimal technology for what they were trying to do. Thankfully they found Phantasma which offers Smart NFTs for game developers, artists, musicians or anyone who wants to tokenize something. For 22 Racing Series they are mostly using Mint On-Demand and Multi-Layer NFTs. Because Jay explained both concepts, I’ll make a short description for both. Mint On-Demand means that game developers don’t need to create the NFTs in advance paying fees for NFTs that might not sell. So every time someone buys an NFT, that NFT is created instantly at the time of buying. They already sold almost 300,000 NFTs. They couldn’t anticipate this massive amount of NFTs that got created so this saved them a lot of time and money. The Multi-Layer NFT is a beautiful concept integrate perfectly into 22 Racing Series (check the picture below). It means a 22 RS hypercar is build from multiple smaller NFTs (25 NFT /car). This NFTs put together will form the car, but you can also disassemble the vehicle and have every vehicle part separately which you can sell on the marketplace. You can also buy from the marketplace different vehicle parts and build your own and unique hypercar.

Part 3 – Quiz about project

In the final part, we tested the knowledge in terms of the Phantasma chain project. They’ve prepared 4 questions for this part, so everyone could be a part and answer. Participants had 10 minutes to answer. 600$ was distributed between the winners.

Our contacts for more details:

English Telegram group | Russian Telegram group | Spanish Telegram group | Telegram Channel | Twitter | Website

Our Crypto Partner by this AMA: Phantasma chain

Telegram group | Discord | Tweeter | Website | Medium